Stock Option Trading Strategy: Bullish put spreads and bearish call spreads with SPY above 141.

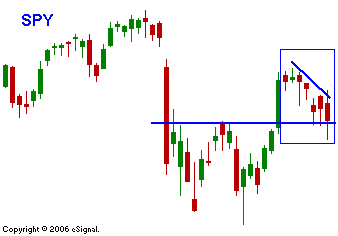

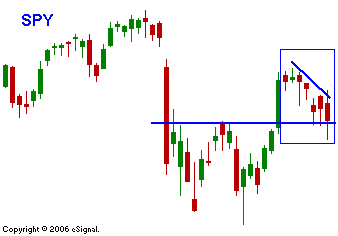

The market is struggling to hold the SPY 141 level. Yesterday the market opened higher and it looked like a solid GDP number might give the market a boost. By late morning the gains were erased and the downside was tested. The market dropped down to SPY 141 and it made a convincing snap back rally into positive territory. Once again, buyers dashed the hopes of bearish traders. I suspect that the rally resulted from end-of-month buying and “window dressing” as the first quarter draws to a close. This morning, the market opened higher and it liked the Chicago PMI (largest gain in 39 years) and the inflation reading from the PCE. After two hours of trading, the market reversed on news that the US would impose trade sanctions against China. The decision pertains to paper products, but it has wide spread implications. The bottom line is that the market is searching for a direction. A battle line is being drawn at this level and for the time being, the best strategy is to sell out of the money call spreads and put spreads to take advantage of the range. At best, I am market neutral, at worst I am bearish. If the market breaks below SPY 141, I would buy in my bullish put spreads and I would buy puts on relatively weak stocks. Today’s chart shows how the market is testing the SPY 141 level. It has not been able to hold the gains from last week.

Daily Bulletin Continues...