Stock Option Trading Strategy – Long energy stock call options and short bull put spreads.

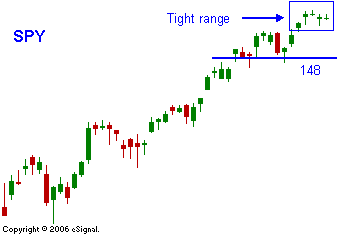

This morning the market continues to chop around. Overseas markets were relatively strong but that influence could not muster a rally here. CSCO announced decent earnings and it gave good guidance, yet the stock is trading $2 lower. All eyes will be fixed on the FOMC comments. I believe the rhetoric will stay the same and the market might not be receptive to the current "tight light" bias. There aren't any catalysts to drive the market to a new all-time high. I believe a light round of profit taking might set in until next week. The market is likely to find early support and an option expiration related rally might push it to new highs. For the remainder of the week be prepared for choppy, directionless trading. Use this quiet period to conduct research. Specifically, review this quarter’s earnings releases and look for companies that have raised guidance. These will make the best longs during the next rally. I continue to trade bull put spreads on stocks I like and I am long calls in energy stocks.

Daily Bulletin Continues...