Daily Option Trading Strategy.

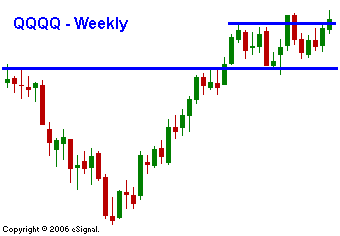

The market has staged a major breakout this week. It has a pattern of making a new high and pulling back. That is exactly what it is doing today. The Fed Chairman did not pull any punches during his Humphrey-Hawkins testomony the market responded with a rally to new highs. The PPI came in as expected, but the Housing Starts were weak. That has the market in a bit of a slump today. I used a weekly chart of the QQQQ today to show that the tech stocks are trying to breakout. They have managed to grind back to their high. It will take a news event or a major announcement from a tech leader to create a breakout. Options backdating and Vista comments from MSFT are putting too much pressure on the sector for that to happen in the next few days. With the long weekend ahead, keep positions small. The bears are toothless and we are not likely to see a sell off today. Look for prices to grind back to unchanged. The cyclicals are still strong and selling put spreads on the heavy machinery stocks continues to be a winning strategy. The earnings are good and the prices are showing support even when the market dips.

Daily Bulletin Continues...