Wednesday’s Stock Option Trading Strategy

Stay long commodity stock options. Relative strength and volume make them good option trading candidates.

Yesterday, the market rallied to new highs after the FOMC minutes were released. As expected, the Fed felt inflationary pressures were contained and they were concerned about future economic growth. Traders that are favoring another rate cut were encouraged by the dialogue.

Commodity stocks have been leading the way higher. Today, AA missed its number and the stock is trading lower despite announcing a share buyback program. Surprisingly, the other mining stocks are still trading to the upside. MON also missed their number. After a $6 drop on the open, the stock snapped back and it is only down $1. Other agricultural stocks are hanging tough. Perhaps the biggest news came from CVX. They missed the number and they said that refining spreads are narrowing. Energy stocks have been a big contributor to the recent rally and they are all trading lower today.

There is skittishness ahead of tomorrow's retail sales number. I believe that the worst case scenario has been factored into these stocks. They are approaching a period of seasonal strength as the holidays draw near. Much like the housing stocks, I believe they are ready to bounce off of current support levels even if the news is dismal. I do not want to get long this sector; however, this price behavior will add a little firepower to the market.

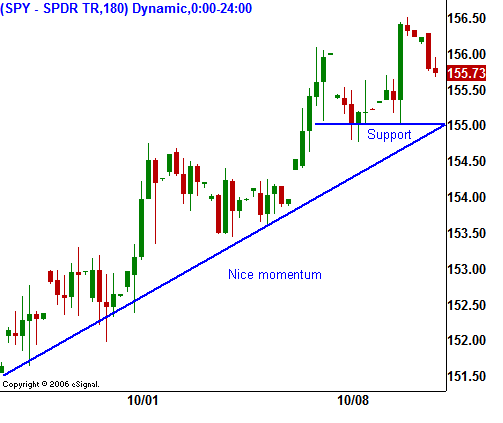

Asian markets put in a nice rally and I do not believe the market will post big losses today. In the chart you can see that there is a support level at SPY 155. The path of least resistance is higher and after yesterday's rally, the bears are licking their wounds.

Friday, GE releases earnings and I am expecting good results. That should fuel multinational industrial stocks.

Even with a spattering of weak earnings, commodity stocks have been able to hold their own and I believe that is the place to stay long. I would favor mining and agriculture over energy. Technology stocks have also been strong relative to the market. Avoid semi conductor stocks and focus on computers, communications, and biotech.

Daily Bulletin Continues...