Tuesday’s Stock Option Trading Strategy

Stay long basic materialsstock options. The momentum is strong and option trading is brisk.

This morning the market is off to a solid start. Overseas markets were moderately higher and that has spilled over to our market.

At 1:00 CT, the FOMC minutes will be released. That could be a driving force for the market today. There was a unanimous decision to lower interest rates and that rhetoric might encourage those traders that seek another rate cut. I want to know what spooked the Fed and I will be looking for indications that the economy will be slowing. The data suggest the economy is in good shape.

Retail sales are on deck Thursday and the estimates have been greatly reduced. Many retail stocks are down today. I feel that a worst-case scenario may be built in and any glimmer of hope could rally these stocks as we head into the holiday season. I am not suggesting that you get long retail stocks. This is a lagging sector. There are a few attractive stocks, but that's where I draw the line.

After the close, Alcoa will kick off the season when it releases earnings. I don't feel it will have a big impact on the market; however, their numbers have been well received the last three quarters. GE releases earnings Friday before the open. I expect a good number.

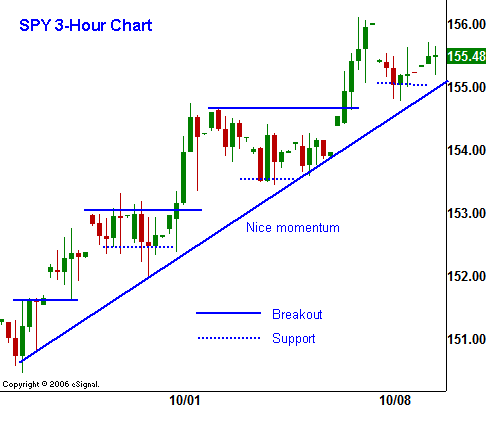

The path of least resistance is up and you have to stay long this market. Full employment and lower interest rates will translate into a new high if earnings and guidance meet expectations. Currently, the consensus estimate is for 0% earnings growth year-over-year. I believe that is a low hurdle.

Basic materials stocks are still the place to be. They continue to lead the market. Most of them are over bought on a short-term basis and they will pullback sharply if the market declines. Make sure you use a trailing stop for these holdings.

For today, look for an afternoon rally that gets us close to Friday’s close. Let the financial stocks be your guide after the FOMC minutes are released. As they go, so goes the market. Use the XLF to gauge the reaction.

Daily Bulletin Continues...