Tuesday’s Stock Option Trading Strategy!

Limit your option trading the next few days. The volume will be light and the action will be choppy.

Today's rally feels like a short covering bounce. In the early going, prices are up on earnings news from Nordstrom’s and Hewlett-Packard. Wealthy consumers are still spending money; however, that is not the case for the average consumer. TGT also announced earnings and the stock is trading lower.

Hewlett-Packard's numbers were solid and that helped to fuel a rally in tech stocks. Tech recently dropped 10% in a week and a nice bounce was overdue. Unfortunately, Hewlett-Packard warned that PC sales would not continue to expand at the current pace.

The year-end rally is unlikely to materialize. Within that seasonal pattern, the days leading up to Thanksgiving contain a micro bullish period. Since the bigger rally has not been able to unfold, I believe today's rally might be short-lived.

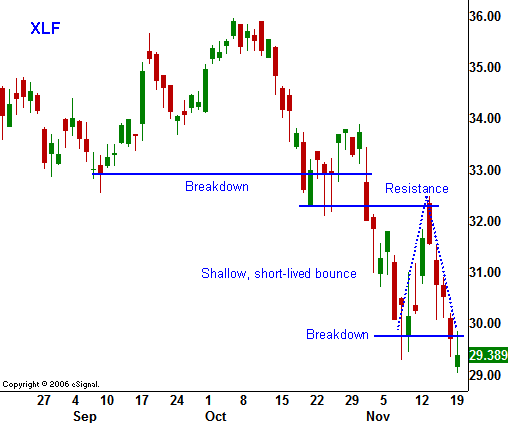

If you look at the chart, you can see that the XLF rally was nothing more than a short covering bounce. It was shallow and short-lived. The support level from which that bounce began has been breached today. Overnight, news from government sponsored mortgage lender Freddie Mac was concerning. The nation’s number two buyer and guarantor of home loans lost $2 billion in the third quarter and it must raise fresh capital to meet regulatory requirements. This news has traders calling for another interest rate cut and I believe that is the true reason for today's rally.

Yesterday, the market sold off on a Goldman Sachs’ downgrade of Citigroup. By comparison, that news doesn't hold a candle to the magnitude of today's announcement. Financial stocks are the largest component in the S&P 500. If they stayed flat, the market might stage a short-lived rally. If the financial stocks are moving lower, they will drag the rest of the market down. This sector must find support in order for the market to have a meaningful rally.

Today's news was simply not that strong. Hewlett-Packard is already trading lower and the overall news from the retail sector has been weak. Nordstrom's is the exception, not the rule. Traders are taking time off for the holiday and trading will be light the rest of the week.

For today, I believe we are close to the highs of the day. SPY 146 represents formidable resistance. The market has had a tendency to establish early momentum and continue in that direction. I have seen a lot of late day selling in the past few weeks and I would not get long this rally. Tomorrow we get jobless claims, LEI, and consumer sentiment. Friday, there aren't any scheduled economic releases. These numbers lack punch and I do not believe they will fuel the market. Earnings releases are dominated by retail stocks this week and that is also likely to weigh on the market.

I don't like to trade light, holiday markets so I am reluctant to get short. Everything I look at tells me that this market bounce won't last. If you decide to get long, make sure you don't hold any positions overnight. I need to see a few consecutive days of positive price action that pushes us through SPY 149 before I can have any lasting confidence in bullish positions.

P.S – If you subscribe to the Daily Report I hope you caught the FNM trade from Friday. I worded the language as strongly as I could to go short. That trade is up $10 in 2 days!

Daily Bulletin Continues...