Tuesday’s Stock Option Trading Strategy!

It time to stick a fork in the year-end rally and option trading should focus on premium selling strategies.

Where is the next round of good news going to come from? Earnings are out and they did little to impress, inflation is creeping higher, the Fed will not lower rates, the dollar is weak, retail sales are down and financial stocks are taking massive write-downs.

Today, Goldman Sachs downgraded Citigroup to a sell. Credit worries continue to plague the market. Last week we saw a bounce in the XLF. It was hard to tell at the time if it was a short covering rally from an oversold condition or if a legitimate support level had been reached. Now we know that the bounce was very shallow and weak. The financial sector is making new lows and it continues to weigh heavily on the market. It could take up to a year before the full extent of these losses is known. When the last writedown has been taken and the earnings start to rebound, the sector has a chance for a legitimate rally.

There are many mortgages that will adjust in the coming months from low promotional rates to higher current rates. That is likely to create another round of defaults. This event is also weighing on retail stocks. Consumers are cautious and they have cut back their spending.

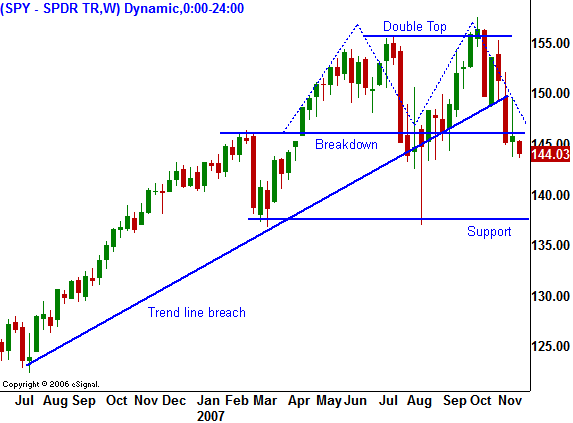

From a technical standpoint, today's chart pretty much says it all. You can see that each of the declines has been deeper and longer lasting than the prior one this year. They are also more frequent. I am not as worried about big, fast declines in a five year uptrend. Those sell offs tend to be "washouts" and they keep speculators honest. The decline we are currently in has a different feel. The rallies are short-lived and the sellers are persistent. Each day the market tries to find a bid, and then eventually the selling sets in.

Notice the double top that has formed. That is a formidable resistance level and it will take fantastic news for the market to break out above that level. An 18 month up trend line has been broken, the horizontal SPY 146 level has been broken and the market is trading below its 200 day moving average. These events all paint a very "heavy" picture for the market.

I’m not bearish because I still see value. Unlike the year 2000, I am seeing some fantastic buying opportunities in the market. The world economy is dependent on our well-being, but not to the extent that it was a decade ago. Companies that generate more than half of their sales overseas present great opportunities and to a large degree, they are immunized from a falling dollar.

I have shifted my bias from bullish to a neutral. Most of the time, the market is not in a trend and I believe we are going to fall into that trading pattern for at least a year. There will be opportunities on both sides of the market and this is one the daily report can truly shine. Try to carry a balance of long and short positions. This will reduce your market risk as the market chops back and forth. In many instances you will make money on both your longs and shorts.

For today, the market has broken below significant support levels and downward momentum has been established. I am expecting the market to close lower today. If the market makes a new intraday low after 2:00 p.m. ET, expect a sell off into the bell. The chance of a bullish reversal today is minimal due to a lack of good news.

Daily Bulletin Continues...