Stock Option Trading Strategy – Long call options on energy stocks and short bull put spreads.

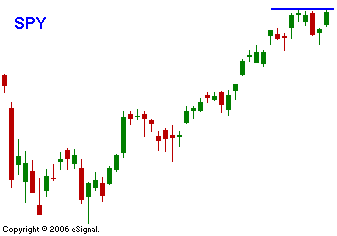

Now that all of the players are back from holiday, the market is blasting higher. Overseas markets were up and they provided the lift we needed. We also had another solid round of earnings. As a result, the S&P 500 is trying to make a new multi-year high today. This market is in a never say die rally. It continues to shrug off all negative news and it is marching higher. Friday the Unemployment Report will be released. Even if it shows a rise in the unemployment rate and an increase in wage inflation, I doubt that combination will have a long-lasting negative affect. This week the market has been able to overcome the negative GDP report from last week. Earnings releases will continue to hold the key for the next few weeks. They have been positive and I expect the market to continue to move higher. From a trading standpoint I am long call options in energy stocks and I have a variety of bull put spreads on stocks that I like. If the S&P 500 can continue to hold the breakout for a couple more weeks, I will consider a bullish bias. The market has a nice rally going today but I do not believe it will be able to break out to new highs. There isn't a big enough catalyst to push it higher ahead of Friday's number. The advance/decline line is a positive 3:1.

Daily Bulletin Continues...