If Stock Option Trading Strategy -Bull put spreads and call options on energy stocks.

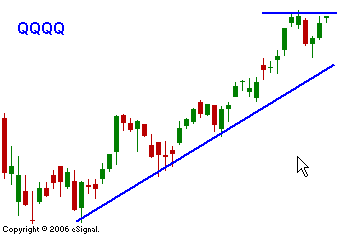

Yesterday’s big rally helped pave the way for overseas markets. Even though the Japanese and Chinese markets were closed for holiday, the other Asian markets surged to new highs. This morning nonfarm payrolls rose. New data showed stronger than expected productivity and below-forecast labor costs. The ISM also came in better than expected. The earnings releases have generally been positive with the exception of GM. I expect relatively light trading given the holiday-like setting. Traders will not take large positions ahead of the all-important Unemployment Report tomorrow. The news today was positive and the path of least resistance is up. I expect the market to grind higher today. In all likelihood the range for the day will be set by noon Eastern Time. My option trading strategy remains the same: bull put spreads, and long call options on energy stocks. Even if we get a rise in unemployment and wage inflation (worst possible combo) I believe any negative reaction will be temporary. There is a much greater chance that the report will generate a positive response. The market is on a mission and it wants to go higher. Today's chart shows that tech stocks are still lagging the S&P 500 and they are trying to make a new relative high.

Daily Bulletin Continues...