Wednesday’s Stock Option Trading Strategy!

The intraday stock market conditions have changed and day trading stocks is not as easy as it was a week ago. Focus on premium selling option trading strategies and distance yourself form the "noise".

Yesterday, the market started off on a positive note. The European Central Bank added $500 billion worth of liquidity in a radical move. After the initial rally, prices reversed and the downside was tested. Once the reversal lost its momentum, the market rallied back to finish the day on a positive note.

This morning, Morgan Stanley announced a huge write off. Fortunately, they had secured a $5 billion investment from the Chinese government and that news helped soften the earnings blow. That capital came at a relatively high cost (higher than what Citigroup offered Abu Dhabi). Goldman Sachs earnings release (Tuesday) was positive, but it did little to excite the market. Traders realize that they are an island within the financial sector.

Trading overseas was generally positive overnight. Europe was up and Asian markets were mixed. Tomorrow, we will hear from Bear Stearns. It is likely that they will also miss the earnings number and I believe that could weigh on the market. We will also get the Philly Fed number, initial jobless claims, and the LEI. Jobless claims will be an important number, but it is released every week. Only a big surprise will move the market. The Philly Fed is likely to carry more weight. If economic conditions continue to slow, the market will not receive the number well. As I've been mentioning, the rate cut safety net has been removed now that inflation is on the rise. Friday we will get the PCE deflator. It is a very important number since the Fed uses it as an inflationary benchmark.

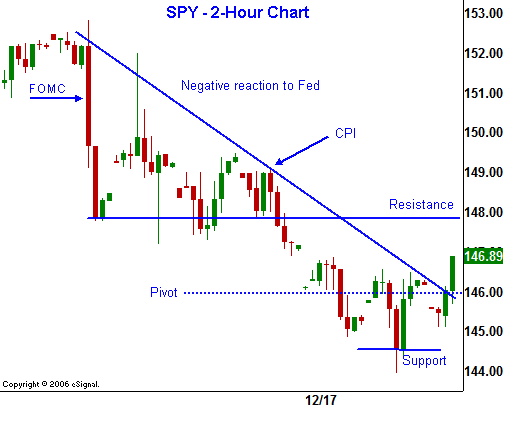

Prices are chopping around today and both sides have been tested. We are headed into quadruple witching and light holiday trading. The combination is likely to result in volatile conditions. Friday marks the beginning of the "Santa Claus rally". That seasonal pattern could lend support to the market. If it does not, a bearish market lies ahead.

Finance companies are raising capital, the Fed is lowering interest rates and adding liquidity, the European Central Bank has added liquidity and the Treasury Department has forged a “mortgage adjustment freeze” program. Anything that can be done - is being done. That is financial crisis runs deep.

Keep positions small and focus on option premium selling strategies. The stock day trading picture has changed and you can no longer count on intraday momentum to carry through to the close. We are currently seeing choppy back-and-forth action and I expect that to continue through Friday.

Daily Bulletin Continues...