Thursday’s Stock Option Trading Strategy!

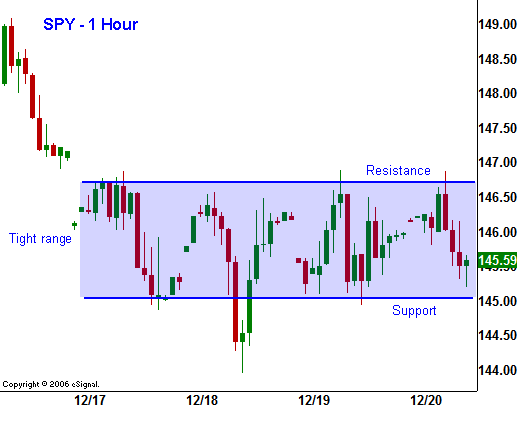

Today, the chart pretty much says it all. We are stock in a very tight trading range and I don't see that changing in the next week. Even quadruple witching has not been able to generate a breakout in one direction or another. The chance for expiration related program trading is greatly diminished.

As I mentioned in yesterday's market commentary, I expected weak performance from Bear Stearns and FedEx. Bear Stearns had new write-downs and FedEx guided lower for next quarter citing week economic conditions and higher fuel costs. The Philly Fed index also came in weaker than expected. All of these factors had a negative influence on the market, but the price action has been fairly muted.

Tomorrow there will be two conflicting forces at play. The bulls will be embracing the start of the "Santa Claus rally" while the bears will sink their teeth into the PCE deflator. I believe the inflation number will win out. This index serves as the Fed’s benchmark and another reminder of rising prices will spook the market heading into the weekend. If the "Santa Claus rally" fails to materialize, bearish price action lies ahead.

This is a time to do research or to finish your holiday shopping. Choppy, low volume action in a range bound market is tough. If you decide to trade, keep your size very small.

Daily Bulletin Continues...