Stock Option Trading Strategy – Long energy stock call options, waiting to buy a dip.

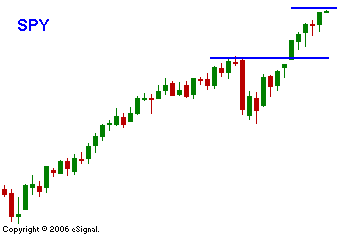

The opening was fairly predictable today. Per normal the market digested and M&A news from the weekend and that gave prices and early boost. The overseas markets were fairly quiet with a bullish bias and currently we are a point away from a new all-time high on the S&P 500. Tech stocks look particularly strong today and that's sector has lagged. The news front is slow today and I expect prices to grind higher and make a new closing high. That will give reporters something to talk about. If that scenario doesn't play out, it will later this week. There might be a little expiration related hangover today given last week's run up. However, I think that was resolved shortly after the open. I will gradually start establishing bull put spreads if we don't get a market pullback this week. I want to distance myself from the action and this strategy will allow me to do that. If we get a pullback that successfully tests support, I will buy calls on stocks I like. I will continue to hold my energy stock call options. This sector has a great deal of strength and I don't believe the macro conditions will change anytime soon. Consequently, these stocks should hold up well and they have already been able to do that during recent down days.

Daily Bulletin Continues...