Stock Option Trading Strategy – Let today’s close be your guide.

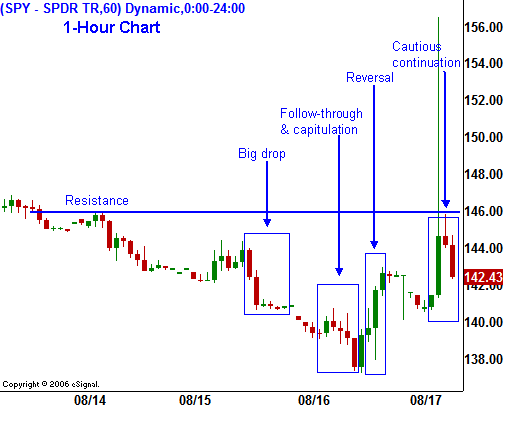

Yesterday, we saw a deep trough that formed after a big day of selling on Wednesday. Solid stocks that have recently announced great earnings and that trade at relatively low P/E ratios were being sold off indiscriminately.

When traders are forced to liquidate holdings to generate cash, they have to sell their strongest positions. That's because they're weakest positions don't have a bid and they are trading at deeply discounted levels. When I saw this unfolding, I felt that we were close to a capitulation level. I instructed clients to buy into the market if an intraday reversal unfolded.

Overnight, Asian markets shrugged off our reversal and they continued to decline. The S&P 500 futures were down 25 points before the open. They continued to grind back in early trading and they were only down 8 points at 7:15 am CST. That's when the Fed announced its move to cut the discount window rate by .5%. Effectively, the Fed takes short-term possession of commercial paper from financial institutions in exchange for cash. In this instance, it is even accepting some mortgages. In the future, the financial institutions will swap cash for their original holdings. All of this translates into the Fed pumping liquidity into a very tight credit market.

This needed to be done since many credit instruments were deeply discounted due to a liquidity crunch. In its statements, the Fed made it known that it is aware of the current issues. I believe it will reduce interest rates by a quarter of a point during the September FOMC meeting. Their action generated an enormous 50 point S&P 500 rally.

.

.

The timing for the policy change caught traders off guard. The SPX index options settled today based on the opening print for every component stock. Translation, a major short squeeze was on. Traders scrambled to offset their risk. The huge opening surge has subsided and the market has stabilized. I really don't know how to call today's market. I can only say that it will paint the picture for next week.

On the plus side, the Fed reacted and they will do what they will fight to avert a liquidity squeeze. The market staged an intraday reversal even before the Fed took action and that is also a positive. The earnings have been strong for the most part and many solid companies have been sold off with the rest of the company. There are good values to be found.

On the negative side, the market has taken back much of the early gains. The overseas markets sold off hard despite our intraday reversal and they may be experiencing issues of their own. Also, the Fed's comments might be painting a weaker picture for the economy. The last hour of trading has tended to be very weak and traders may not want to go home with long positions.

If the market can hold the early gains and even add to them into the close, I believe a temporary low has been formed. The Dow Jones Industrial Average sold off exactly 10% and many technicians would find that to be significant. Any close above SPY 146 would throw me into a short-term bullish camp and I would look for a sustained short squeeze.

The last hour of trading will be very telling.

.

The timing for the policy change caught traders off guard. The SPX index options settled today based on the opening print for every component stock. Translation, a major short squeeze was on. Traders scrambled to offset their risk. The huge opening surge has subsided and the market has stabilized. I really don't know how to call today's market. I can only say that it will paint the picture for next week.

On the plus side, the Fed reacted and they will do what they will fight to avert a liquidity squeeze. The market staged an intraday reversal even before the Fed took action and that is also a positive. The earnings have been strong for the most part and many solid companies have been sold off with the rest of the company. There are good values to be found.

On the negative side, the market has taken back much of the early gains. The overseas markets sold off hard despite our intraday reversal and they may be experiencing issues of their own. Also, the Fed's comments might be painting a weaker picture for the economy. The last hour of trading has tended to be very weak and traders may not want to go home with long positions.

If the market can hold the early gains and even add to them into the close, I believe a temporary low has been formed. The Dow Jones Industrial Average sold off exactly 10% and many technicians would find that to be significant. Any close above SPY 146 would throw me into a short-term bullish camp and I would look for a sustained short squeeze.

The last hour of trading will be very telling.

.

The timing for the policy change caught traders off guard. The SPX index options settled today based on the opening print for every component stock. Translation, a major short squeeze was on. Traders scrambled to offset their risk. The huge opening surge has subsided and the market has stabilized. I really don't know how to call today's market. I can only say that it will paint the picture for next week.

On the plus side, the Fed reacted and they will do what they will fight to avert a liquidity squeeze. The market staged an intraday reversal even before the Fed took action and that is also a positive. The earnings have been strong for the most part and many solid companies have been sold off with the rest of the company. There are good values to be found.

On the negative side, the market has taken back much of the early gains. The overseas markets sold off hard despite our intraday reversal and they may be experiencing issues of their own. Also, the Fed's comments might be painting a weaker picture for the economy. The last hour of trading has tended to be very weak and traders may not want to go home with long positions.

If the market can hold the early gains and even add to them into the close, I believe a temporary low has been formed. The Dow Jones Industrial Average sold off exactly 10% and many technicians would find that to be significant. Any close above SPY 146 would throw me into a short-term bullish camp and I would look for a sustained short squeeze.

The last hour of trading will be very telling.

.

The timing for the policy change caught traders off guard. The SPX index options settled today based on the opening print for every component stock. Translation, a major short squeeze was on. Traders scrambled to offset their risk. The huge opening surge has subsided and the market has stabilized. I really don't know how to call today's market. I can only say that it will paint the picture for next week.

On the plus side, the Fed reacted and they will do what they will fight to avert a liquidity squeeze. The market staged an intraday reversal even before the Fed took action and that is also a positive. The earnings have been strong for the most part and many solid companies have been sold off with the rest of the company. There are good values to be found.

On the negative side, the market has taken back much of the early gains. The overseas markets sold off hard despite our intraday reversal and they may be experiencing issues of their own. Also, the Fed's comments might be painting a weaker picture for the economy. The last hour of trading has tended to be very weak and traders may not want to go home with long positions.

If the market can hold the early gains and even add to them into the close, I believe a temporary low has been formed. The Dow Jones Industrial Average sold off exactly 10% and many technicians would find that to be significant. Any close above SPY 146 would throw me into a short-term bullish camp and I would look for a sustained short squeeze.

The last hour of trading will be very telling.Daily Bulletin Continues...