Stock Option Trading Strategy – Get ready for the big intraday reversal and place stock buy-stops.

We are now in a full-blown sell off. The global markets are participating as traders move to cash. The Yen-carry trade is being unwound and that is creating pressure on commodities/commodity stocks. Hedge funds were borrowing cheap Japanese debt and using it to buy commodities. While the global liquidity was robust, this trade worked out well. Now that everyone is scrambling to get into cash, it's a different story.

The commodities stocks that led the rally back in April and May have fallen on hard times. The good news is that global expansion is still alive and well. New projects will be scrutinized more carefully than they were a few months ago; however, they will not come to a screeching halt. These companies have been busy in M&A and they know that they are the owners of finite resources that are in high demand. As the stock prices drop, they will be busy buying back shares with all of their cash flow.

I am finally seeing some of the very strong stocks tank in this panic sell off. That tells me that a short-term low is near. The market is extremely oversold and in the next few days I am expecting a big intraday reversal. This is a great time to line up stocks that have not changed fundamentally and that are less prone to an economic slowdown. As an example, BA has a record backlog for many years. It trades at a one year forward P/E of less than 15 and it is 15% off of its high. There are many such examples.

When the capitulation happens and the market reverses, it will take place in a matter of minutes and you will not have time to react. I am already layering buy orders on stocks that I want to own. I'm not trying to average in. Rather, my orders are buy-stops so that if the market reverses and breaks through a minor resistance level the orders will be triggered as the stocks participate. Once the move materializes, you will not have time to enter all of the orders. The stocks will be moving too quickly.

If the market continues to tank, I don't have any downside risk with this strategy. When the market does finally start to recoup, I will make money on the stocks. In these situations I prefer buying the stock to buying in the money calls. The bid/ask spread is so wide on the options that you never know where you will get filled. Also, the implied volatilities are so high it as the market rallies, your calls will be swimming upstream because they are fighting a collapse in implied volatility. I like to hold my stock positions and look for opportunities to sell put premium as the market rallies.

.

.

This strategy assumes that we are in a panic sell off and that the market will form a "V Bottom". I believe that that is a distinct possibility. The sell off is not due to a change in the macro environment. It is due to poor lending policies, excess liquidity and over leverage by traders. Once this adjustment takes place, a fantastic buying opportunity will present itself. Corporate earnings are strong, the balance sheets are as good as they've ever been, the valuations are relatively cheap, interest rates are low, inflation is in check, and employment is full. The U.S. consumer is tired, but I feel that other parts of the world are ready to pick up some of the slack.

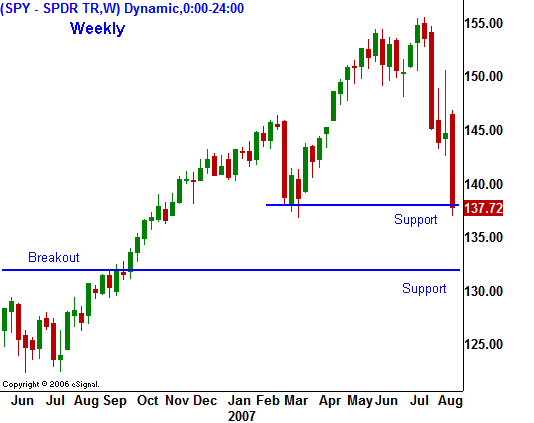

I believe we will find support at SPY 132. That was a significant breakout level in 2006. One more trading day like today will get us down to that level. For today, we are testing the lows from last March and I believe this level will hold. Tomorrow is expiration Friday and if the panic continues, we could have another down day.

.

This strategy assumes that we are in a panic sell off and that the market will form a "V Bottom". I believe that that is a distinct possibility. The sell off is not due to a change in the macro environment. It is due to poor lending policies, excess liquidity and over leverage by traders. Once this adjustment takes place, a fantastic buying opportunity will present itself. Corporate earnings are strong, the balance sheets are as good as they've ever been, the valuations are relatively cheap, interest rates are low, inflation is in check, and employment is full. The U.S. consumer is tired, but I feel that other parts of the world are ready to pick up some of the slack.

I believe we will find support at SPY 132. That was a significant breakout level in 2006. One more trading day like today will get us down to that level. For today, we are testing the lows from last March and I believe this level will hold. Tomorrow is expiration Friday and if the panic continues, we could have another down day.

.

This strategy assumes that we are in a panic sell off and that the market will form a "V Bottom". I believe that that is a distinct possibility. The sell off is not due to a change in the macro environment. It is due to poor lending policies, excess liquidity and over leverage by traders. Once this adjustment takes place, a fantastic buying opportunity will present itself. Corporate earnings are strong, the balance sheets are as good as they've ever been, the valuations are relatively cheap, interest rates are low, inflation is in check, and employment is full. The U.S. consumer is tired, but I feel that other parts of the world are ready to pick up some of the slack.

I believe we will find support at SPY 132. That was a significant breakout level in 2006. One more trading day like today will get us down to that level. For today, we are testing the lows from last March and I believe this level will hold. Tomorrow is expiration Friday and if the panic continues, we could have another down day.

.

This strategy assumes that we are in a panic sell off and that the market will form a "V Bottom". I believe that that is a distinct possibility. The sell off is not due to a change in the macro environment. It is due to poor lending policies, excess liquidity and over leverage by traders. Once this adjustment takes place, a fantastic buying opportunity will present itself. Corporate earnings are strong, the balance sheets are as good as they've ever been, the valuations are relatively cheap, interest rates are low, inflation is in check, and employment is full. The U.S. consumer is tired, but I feel that other parts of the world are ready to pick up some of the slack.

I believe we will find support at SPY 132. That was a significant breakout level in 2006. One more trading day like today will get us down to that level. For today, we are testing the lows from last March and I believe this level will hold. Tomorrow is expiration Friday and if the panic continues, we could have another down day.Daily Bulletin Continues...