Stock Option Trading Startegy – Buy calls on heavy equipnment, global construction, energy, mining.

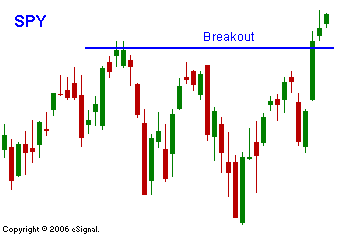

The market continues to forge ahead and it is adding to last week’s breakout. Overnight, Asian markets were down slightly and that negative overtone failed to impact our market. This is a huge earnings release week and that news will drive the market. The PPI and CPI are also due out this week, however, those numbers have not been as dangerous as you might suspect. In the last few months, the market has been able to rally after the release of the PPI and CPI. This behavior reminds me of the Retail Sales number last week. It was dismal, but not catastrophic, and the market rallied on the news. Inflation has been on the rise, but not enough to dampen the spirits of the bulls. The Fed Chairman will also be speaking a couple of times this week and that is a potential “fly in the ointment”. Going into expiration, we had a solid breakout with follow through. I believe that we will see option buy programs this week and they will drive the market to new highs. Earnings are slated for single-digit growth and I believe the majority of companies will exceed expectations. As long as the 10 year yield stays below 5.25%, I believe we will have a very strong week. Stay long heavy equipment, mining, international construction, and energy. For today, the market has established a narrow range and I don’t think we will see much of a move this afternoon. Traders will wait to see how earnings and the inflation numbers come out before they add to their holdings.

Daily Bulletin Continues...