Stock Option Trading Strategy Today: Prepare to buy-in put credit spreads – buy put options.

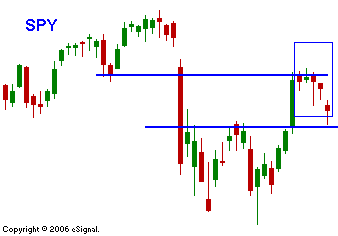

I've been pretty vocal about how the market has discounted every shred of bad news. Even now, as the evidence mounts, the "spin doctors" are looking for a silver lining. Normally, the Fed Chairman has a positive influence on the market. That might still happen today, however, I heard concerns about a slowing economy and elevated fears of inflation. Productivity has slowed and resource utilization is very high. If companies absorb higher costs, the profit margins will be impacted. If they pass on higher costs, the consumer will experience higher rates of inflation. Neither outcome is desirable. I can't wait to hear the first positive twist on these developments. Chairman Bernanke is always very hedged in his statements and there were comments about full employment and a "resilient consumer". He also stated that the recent $2 spike in oil was not factored into his statements and it needs to be. In other words, sustained oil prices above this level could cause them to move rates higher. Gasoline inventories are low and there has been a draw on crude. Driving season is upon us and with the unrest in the Middle East; prices are not coming down anytime soon. The market spiked when it broke above SPY 141 and part of that rally was short covering. As you can see in the chart, we are not able to hold the gains. It is likely that we will test SPY 141 today and we may see a sharp decline. The market has been able to string 3 negative days together and that could be very damaging for the bulls. The bears would prefer to have a steady decline because it is sustainable. The large "air pockets" and snap back rallies are more noise than anything else. If we close below SPY 141 and there continue to be consecutive declining days, get short. The option implied volatilities are on the rise, but they are not expensive. I will buy in my put credit spreads and I will buy puts on weak stocks if that happens. I believe the bears will be able to drive the market lower today. For more information on trading declines, read my article, "Option Trading Strategy For “V” Bottoms - Leg #1."

Daily Bulletin Continues...