Stock Option Trading Strategy: bear call spreads and bull put spreads.

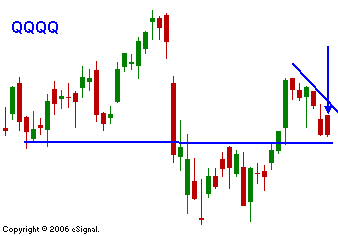

Yesterday the market was not able to overcome statements by Chairman Bernanke. The bulls wanted to hear neutral, but instead they heard “tight light”. There is no way to spin the rhetoric; the Fed is more concerned with inflation than an economic slowdown. Today’s GDP number showed solid growth and modest inflation. That news created a “pop” on the open and the A/D is a positive 2:1. The overseas markets were positive and the bulls have the wind at their back today. They also have an ace up their sleeve in end of month buying. It is normally strong during tax season when retirement accounts are funded. The bears want to see how much fire power the bulls have. If the market can’t hold the early rally, the bears will try the downside this afternoon. We are within striking distance of SPY 141 and I feel it will be tested soon. The market had its third consecutive down day yesterday and it closed on its low. In the QQQQ chart you can see the decline yesterday and the attempted tech rally on the open today. It failed early and time will tell if those stocks will recover to make a new intraday high. For today, I expect a range between SPY 141 – 143. Stock option trading strategy: bear call spreads and bull put spreads. If SPY 141 is breached I will buy-in the put credit spreads and I will buy puts on weak stocks. If the market rallies, I will hold current positions. I do not believe we will see a new multi-year high anytime soon.

Daily Bulletin Continues...