Stock Option Trading Strategy – Bull Put Spreads

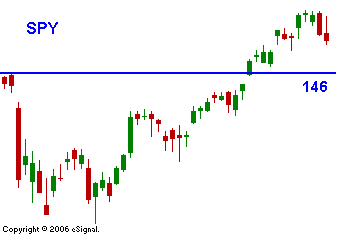

Yesterday and today a number of foreign markets have been closed for trading. During these light holiday sessions it is apparent that profit taking is setting in. Our market does not have the earnings catalysts on deck that it had last week. There were a number of blockbuster releases that helped drive the market to new highs a few days ago. This week the earnings have been rather subdued. The foreign markets have been very strong and their positive overnight performance hasx created a bullish backdrop for our markets. Our market has not had that crutch to lean on so far this week. End of month window-dressing has also concluded and the "sell in May and go away" adage has traders nervous. We may also be seeing the spillover affect from last week's GDP number that showed weakening economic activity and rising inflation. Given yesterday's afternoon sell off and the hal-hearted rally attempt on the open today, I believe that profit taking will set in for the next few days. The SPY 146 level needs to hold. That represents the breakout that we saw in April. This is a good time to take profits on long positions and to lighten up. I will continue to favor put spreads. I am not adding to my positions at this time. I also have a handful of long call positions in energy stocks. They took a little heat yesterday but I feel that they will be able to weather a market pullback. The price action today will allow us to gauge the extent of any profit taking.

Daily Bulletin Continues...