Stock Option Trading Strategy – Long energy calls and adding. Long retail and restaurant puts.

The market has been acting very skittish for the last two months. Starting in June, the volatility increased dramatically. There have been big down days that have resulted from weakness in subprime lending. Once the market finds support, it stages an enormous snap-back rally and it rockets to a new relative high. Last week, the market was just coming off one of those runs. It was set for a big rally during expiration week. As earnings releases came out, the market reacted negatively. Groups that have been leading the market higher posted decent numbers, but sold off after the news. Furthermore, new leadership from lagging groups was not established. Overall, the price action was very weak.

As I mentioned yesterday, the decline was likely to continue throughout the day. Subprime lending woes were accentuated yesterday when CFC hosted its conference call. It added a new wrinkle to the problems when it explained that higher interest rates are impacting more than just subprime. Retail and restaurant stocks continued to post soft numbers and I believe the consumer is tapped out. On the open today, it looked like we might have a bounce. After an initial rally, the market reversed quickly on news that part of the Chrysler deal might fall through. If financing deals drop off, that will have a negative impact on the market. Don’t worry, that is unlikely since the world is flush with liquidity. Sound deals will find money. Chrysler is not a safe bet and I’m not surprised they are having issues. Why else would Daimler be willing to take such a loss on the business just to get rid of it? On the other hand, a company like DADE that has increasing earnings and growth rates was a prime acquisition target. I featured that stock in the Daily Report two weeks ago and I hope some of you nailed that take over. Companies are still buying back shares and that will continue.

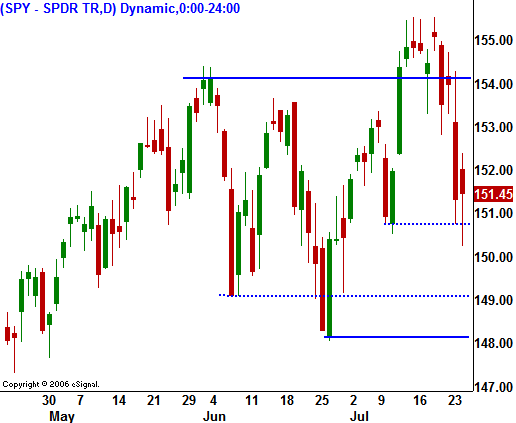

Overall earnings have been decent. Oil is rebounding after the inventory number and I believe this is a good entry point for some of the drillers. Retail and restaurant stocks continue to struggle and I like being long puts in those stocks. I have included a few horizontal support levels in today’s chart. SPY 150, 148 and 146 are important. The A/D ratio is a negative 1:2 and I believe the market will continue to test the downside today. Analysts have been worried that higher interest rates might affect other loans. CFC is one of the strongest lenders and their comments were very damaging.

Daily Bulletin Continues...