Stock Option Trading Strategy – Long energy stock call options and long retail and restaurant puts.

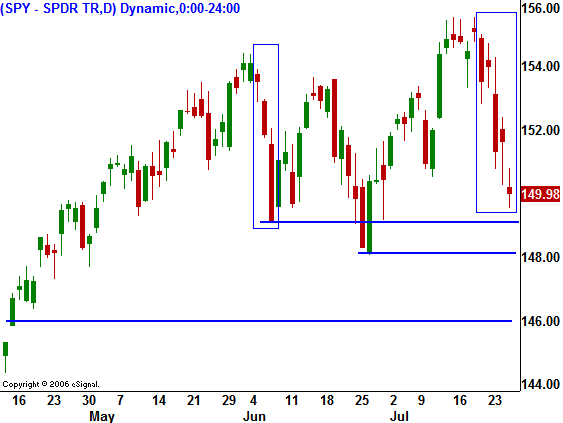

The market has decidedly taken on a negative tone the last five trading days. If you look at the chart you can see that the last two times the market rallied up to new all-time highs, it was met with resistance. Also note the wide trading ranges that have become common. This price action normally precedes a larger move. A struggle between the bulls and the bears has emerged as the market transitions.

Within the next month we’ll know if the subprime issue is spreading into other areas. That’s the early indication that we got from CFC’s earnings release this week. They claim defaults are spreading to other parts of their lending portfolio. If this is contagious, liquidity could dry up. On the other hand, this decline could be an over reaction. Strong corporate balance sheets and solid earnings could fuel this market in a low interest-rate environment. Personally, that is the camp I’m in for at least the next few months. I believe strength in other areas will more than offset weakness in the housing market. Money was too loose and credit needed to be tightened.

My longer-term concern is high debt across many levels; federal, state municipal, personal. The U.S. has recorded its 26th consecutive month where the personal savings rate is negative. That condition can’t last and consumers will have to restrict their spending. I’m also concerned that the Democrats will take office and raise corporate taxes. U.S. corporations are already at a competitive disadvantage given health insurance costs, wages, Sarbanes-Oxley, EPA, and a gamut of other regulations. Cap Ex in this country is falling and corporations already prefer to invest overseas. We already have the second highest corporate tax rate in the world. Higher corporate taxes would prompt other U.S. companies to follow HAL’s example to move overseas. This would be catastrophic. The U.S. would lose a huge tax source, not to mention the confidence of the American people. These two issues will weigh heavily on the market early next year.

For now, I’ll gauge the selling pressure. As long as the market can stay above SPY 146, I will remain bullish and I will maintain my “buy the dip” mentality. I like U.S. companies that generate more than half of their sales overseas. Construction, heavy equipment, and energy are my favorite areas. If the bears can’t establish a new low after 1:00 pm EST, I believe the market will rally back and erase most of today’s losses. If the bears can make a new afternoon low, prices will continue to drift lower right into the bell. SPY 148 was a relative low established in June and I expect that level to hold this week. Stay short restaurant and retail stocks and look for buying opportunities in energy, heavy equipment and construction.

Daily Bulletin Continues...