Stock Option Trading Strategy – Long energy stock call options.

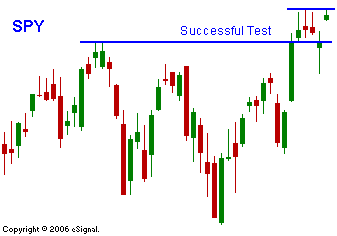

Yesterday the market tried the downside early in the day. Tech stock earnings reports and another subprime lending debacle were to blame. Once the selling was contained, traders rationalized that the earnings news was not that bleak and that subprime lending is and will continue to be an issue. By the close, a nice snap back rally materialized. Option expiration buy programs were executed and that goosed the market. After the close and before the open, solid earnings have been released and the market has made up all of yesterday’s losses. In the chart you can see that the market dipped below the breakout level. Today, we are right up to the all-time highs and that breakout has been successfully tested. I believe that solid earnings and option expiration will fuel this market right into Friday’s close. NE announced solid earnings and I particularly like the drillers and oil service companies. Many cyclical stocks have been beating earnings, but the raised expectations are resulting in muted reactions. It might be time to treat these stocks was a little caution. They have run up very far in a short period of time and they are priced for upside surprises. I expect the market to continue to grind higher and with oil above $75 I believe energy is the best place to be.

Daily Bulletin Continues...