Stock Option Trading Strategy – Long calls in energy, buying puts in retail and restaurant.

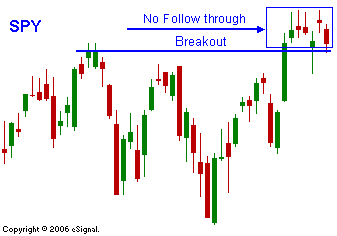

Today let’s start with the chart. As you can see the market has really been struggling to add to the breakout. There is no follow through to last week’s move and every rally seems to fade by the end of the day. As I’ve stated many times, interest rates and earnings drive this market. Interest rates are likely to remain constant for the rest of the year and that makes earnings even more important. My observations from this week tell me that the market might be in trouble short-term. Early in the week we saw some of the financial stocks post solid gains, yet their stocks were hammered after they announced. Growing concerns over subprime and rising interest rates have put a lid on a sector that constitutes 20% of the S&P 500. I expected this sector to lead the market higher this week. I’ve also mentioned that I have not bought into the tech rally. I have not seen raised guidance and I don’t believe the earnings growth is there yet. GOOG, INTC and MOT confirmed my suspicions. Cyclical stocks have been leading this market higher for the last quarter and many of those companies are up 30 to 40% in that time frame. They have posted solid results but the stocks have been pulling back after their earnings release. Today, CAT proved that some of the expectations might be a bit lofty. These reactions tell me that all of the good news is already priced in. I expected that expiration related buy programs would help fuel this market higher. The fact that they did not materialize is not a good sign. It tells me that institutional traders did not see the strength in the market that they needed to leg out of hedged positions. Unless we get a great week of earnings next week, I believe this market could put in a short-term top. The only sector I feel comfortable placing money in right now is energy. That is usually not a good sign for the market. I suggest keeping your long positions minimal. I am long calls in energy stocks and now I am buying puts and some of the retail and restaurant stocks. The financial sector is technically weak, but I feel the earnings have been solid. I don’t like to buy puts on stocks that have low P/E ratios. Some of the financials I think are very attractive at this level, especially the ones that don’t have exposure to subprime. For today, I believe we will see additional selling pressure right into the close.

Daily Bulletin Continues...