Thursday’s Stock Option Trading Strategy!

Today's option trading strategy - BUY PUTS! It is unusual for me to get this opinionated, but today's PPI number was horrible and there is a bearish opportunity.

The market has been struggling ever since the FOMC announcement. Traders wanted to hear "dovish" rhetoric that would pave the way for another interest rate cut. When the Fed expressed inflation concerns, traders realized that they may not get another "fix" anytime soon.

The Fed did resort to another easing tool yesterday and the market reacted with a huge opening rally. By mid afternoon, all of those gains were erased and the S&P 500 staged a 46 point reversal.

This morning, the PPI hammered a huge nail into our economic coffin. Excluding food and energy (who needs those anyway - right?) the index rose .4%, the biggest increase since February. Including food and energy, prices shot up 3.2% for the month (the biggest gain in 34 years). The Fed cannot lower interest rates in light of this type of inflation. They are handcuffed and this economic cycle will have to run its own course.

Interest rate cuts in the US have not resulted in a lower LIBOR rate (the true cost of capital) and they have only helped marginally. When you think about it, the Fed has; lowered the Fed Funds rate, lowered the Discount Window rate and launched a temporary term auction facility to expand the number of banks allowed to borrow money at favorable rates. The Treasury Department forged a plan to freeze mortgage rate adjustments. Do you get the feeling that this crisis might be much bigger than most people expect?

The economic data has been weak. GDP met expectations but only due to rising inventory levels. The durable goods number hit expectations but only because of a 16% rise in defense spending. Housing sales increased 1.7%, but home prices had the largest one-month decline in 25 years. Retail sales were up 1.2%, but how deep were the discounts?

Today, China announced that factory output slowed. They are dependent on global demand. The Chinese government has raised interest rates five times this year and it is also raised reserve requirements 10 times this year. They are putting on the brakes and they realized that hyper-growth can breed inefficiency. They want to moderate growth in hopes of avoiding a "bubble". It is difficult to determine how loose their credit policies have been, but any economic downturn could spell trouble for their equity markets. Chinese stocks have been in a three-year parabolic rally. I have felt that global expansion might pull us through this mess, but that theory might be flawed.

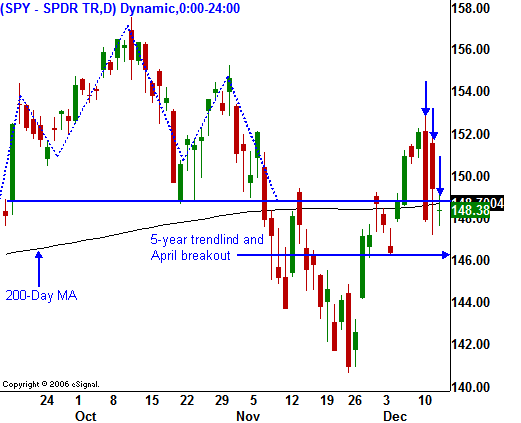

I hate to sound a "gloom and doom" alert, but today's number was very concerning. On the open, the market had already broken support at SPY 149. I expect the momentum to pick up and the SPY 146 level could be tested today. That level is critical since it represents the April breakout and the five-year trend line. The market is also below its 200-day moving average.

The shorts have been the ones getting squeezed on every snap back rally this year. I suspect that the tables will be turned in the next week. Many people have been calling for a "Santa Claus rally". If the market falters, bullish speculators will be shaken hard.

Given the news today, you have to go short. If the SPY closes below 146, add to the short position. Tomorrow, we will get the CPI. I believe it will be slower to react than the PPI and it will not show a dramatic increase in prices. During the early stages of inflation, producers of consumer goods are willing to absorb some of the additional costs. It takes them a while to raise prices. Rest assured, there will be inflation on a consumer level.

Daily Bulletin Continues...