Friday’s Stock Option Trading Strategy!

The stock market looks tired and your option trading should focus on put buying.

Conditions have changed and this is no longer the "Goldilocks market". As I've been pointing out, the economic conditions are deteriorating and the “not too hot, not too cold” metaphor does not apply. The Fed has thrown the kitchen sink at the problem and the market is treading water.

Frankly, I was shocked to see the late day rally yesterday. I felt that a hot PPI number would be the straw that broke the camel’s back. Inflation will handcuff the Fed and this economic downturn will have to resolve itself over time. Normally, there is a lag between wholesale and consumer inflation. Producers are willing to absorb higher costs and it takes time for them to adjust their prices. Surprisingly, the CPI came in hot as well. This is not a good for our market or our pocketbooks.

I thought for sure the market would trade lower and stay down ahead of the weekend. The day is young and that might still happen. However, I'm not seeing the panic I expected. The PPI/CPI has not shown dramatic increases this year and the data could not have been expected by the market.

I am a bit perplexed that the market has not tanked and I'm searching for answers. We know that we are in a seasonally bullish period and that has helped support prices. It is also possible that the market takes comfort in the Fed’s actions. In the last few trading sessions, there has been a positive development. The LIBOR rates have come down a little and the dollar is showing signs of strength (both moves are related).

The last point is interesting since LIBOR rates do represent the true cost of capital. As our rates have come down, the LIBOR rate has remained high. This means that the Fed’s actions have only had a marginal affect. European and Asian markets traded lower over night and that is why the differential narrowed. There is concern that economic conditions are weakening in Europe and Japan. On the surface this might seem like a positive event, however it weakens the theory that global expansion will carry us out of this economic cycle.

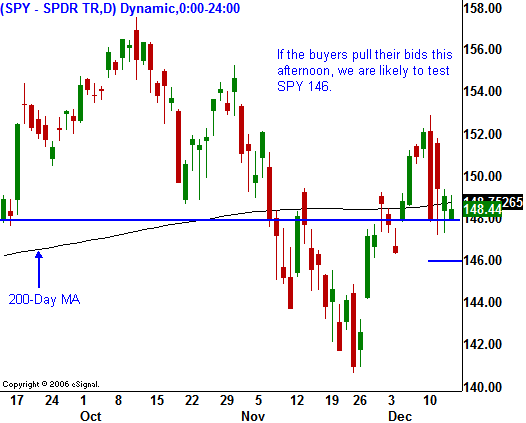

The market tried the downside early this morning. The bulls were able to reverse the sell off and bring the market back to unchanged. However, the rally stalled and the market was not able to head into positive territory. I view this as a victory for the bears today. They have been able to establish a resistance level. The market has backed off and I feel that the bears will be pushing prices lower to see if buyers are still anxious to get long stocks before the weekend.

This is a "Teflon market". It is able to deflect any bad news. These situations usually end quickly. Once the bears have thrown in the towel and the bulls feel confident, the drop happens. I feel we are getting close to that point and I'm expecting an afternoon sell off. Mind you, I expected the same yesterday.

In light of the CPI, and weaker trading overseas, I believe the table is set. If the SPY makes a new intraday low, go short. The momentum will take over from there. We are very near key support levels and if the market breaks below SPY 146, serious technical damage will have occurred.

For Asset Managers who are bullish, it is easier for them to wait until Monday before they establish long positions. By waiting, they can assess the news over the weekend and perhaps a takeover will fuel prices. I simply can't imagine anyone being an aggressive buyer in this environment. If the bid disappears, the sellers will take over.

Daily Bulletin Continues...