Stock Option Trading Straqtegy – Keep your powder dry or balance bullish and bearish positions.

Last week the market had its worst five day showing in over three years. Two weeks ago we saw companies release earnings that beat expectations and the market reacted negatively towards the news. Many of the stocks had been leading the market higher and my concern was that the leadership has lost its punch. In order for the market to move higher it had to find strength from new sources. That failed to materialize and the first crack in the dam became apparent.

Last week, CFC announced earnings and it gave a very grim outlook during its conference call. The more they said the worst it got. Traders are concerned about the depth of the lending issues. We now know that the subprime debacle is spreading over into Alt-A and other prime loans. Today, another lender was hit with margin calls and it is doubtful that it will be able to fend off creditors. After Thursday’s 440 point decline in the Dow Jones Industrials, the market was able to stage a late day rally and recoup some of those losses. Friday, the market tested those lows and then it began to climb higher. It was able to ward off a couple of declines throughout the day and it seemed like the lows might have been established. That all changed in the last 30 minutes of trading Friday. Going into the weekend, traders did not want to be long. The buyers pulled their bids and the sellers hit anything they could find. In a matter of 30 minutes, the S&P 500 futures were down 20 points and they continued down another 10 points in after-hours trading.

It is likely that many speculators felt the overseas markets would follow our lead and they would be down Sunday evening. To my surprise, foreign markets held up extremely well. In fact, the Shanghai index made a new all-time high even after the Bank of China raised reserve requirements. I thought that price action would set a very positive tone for our oversold market. There have been a number of attempts to try and drift this market lower today. By midmorning, prices are firm. The last hour of trading will be critical and it will determine where we go next.

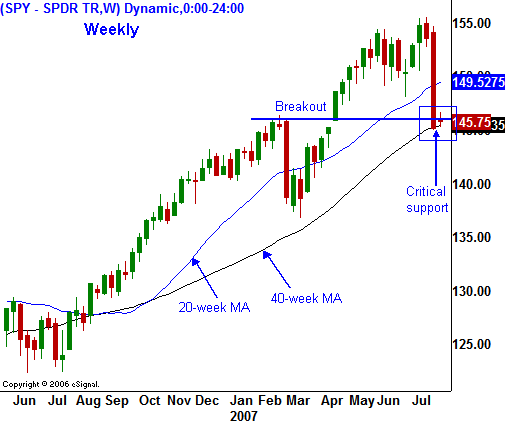

As you can see in the chart the SPY 146 level is critical. That was the breakout from last April. That level also represents the 40-week moving average (200-day MA). You can see that the market is hanging on by its fingernails. I had expected greater support at this level and that tells me that there is more to this decline than a simple pullback. Starting today we should see end of month fund buying and that should lend support to the market. If the bulls feel comfortable that a temporary low has been established, they will come in and support this market. The ensuing rally could be violent since many traders have taken on short positions and they will be squeezed.

The volatility in this market has returned and you can expect two sided price action. The Unemployment Report due out Friday will be very important. Right now, the market wants confirmation that the housing slump is not impacting the unemployment rate. If the number comes out strong, the market will rally. If the unemployment rate increases, the market is likely to trade down.

I have not seen the conviction that I had hoped for today and I am keeping my powder dry. Even some of the energy stocks I like are taking heat. That can be caused from margin calls that are being generated in other areas. If traders are forced to liquidate their holdings, they have to sell everything to release funds. The fundamentals for these stocks are still intact and they will represent a great buying opportunity once they bottom. The retail and restaurant stocks are still very weak and the strength of the consumer remains questionable.

I expect end of month buying to lend support to this critical price level. If the market can avoid a sell-off in the last hour of trading today, it might have a chance of making a decent bounce before the unemployment number Friday. This is a good time to watch. Keep your powder dry or at very least, keep a balance of long and short positions.

Daily Bulletin Continues...