Today’s Stock Option Trading Strategy – Selectively add tech and ADRs to the list of longs.

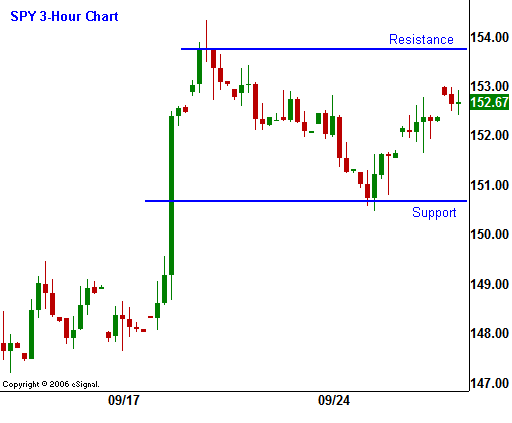

The stock market is settling into a trading range while it waits for news. There is very little momentum for option trading. In today's chart I have highlighted the support and resistance levels. As long as we are between the lines, expect choppy, directionless trading.

This morning, the GDP exceeded expectations and jobless claims fell. As I highlighted earlier in the week, these figures represent the past. I did not expect to see immediate weakness and I felt that “an all’s clear” rally might ensue on the back of end-of-month buying. The initial bullish reaction has faded and trading activity is light. There are a few economic releases tomorrow like personal spending, PCE and the Chicago PMI. I'm not expecting any fireworks from these numbers either. The big economic release will come a week from tomorrow.

Last month, a very weak Unemployment Report that included downward revisions for the prior two months spooked the Fed. If housing starts to affect the employment of credit laden consumers, we could be headed for a recession. That is what the Fed is worried about.

Once earnings season begins, the guidance for next quarter will play a pivotal role in the market’s direction. The retailers hold the key. Consumers have been keeping this economy and other economies afloat. If Americans are tightening their belts, we will see a crack in the dam. If I had to assign a probability, I would say that there is a 30% chance of that happening.

The housing market only makes up 5% of our GDP and I believe that there is a much greater likelihood that global expansion will create jobs in the US and offset the housing weakness.

I'm not going to try and forecast where prices are going to go today in this light environment, but my guess would be higher in the absence of any bad news.

In addition to being long commodity stocks, there are select tech stocks that are showing strength. Foreign ADRs are also a place to be since they are loosely linked to our economy.

Daily Bulletin Continues...