Friday’s Stock Option Trading Strategy – Buy commodities, tech and ADRs, sell retail.

Stock option trading requires momentum. There are pockets in the market that offer "http://technorati.com/tag/option+trading" rel="tag">option trading opportunities. More on that in a minute. First let's get our bearings.

Yesterday the market climbed higher and it was able to hold its early gains. The economic releases were better than expected and the path of least resistance is up.

Today, the economic releases were also moderately bullish and the market had an initial favorable reaction. Once trading got underway, the bid to the market slipped away. Today marks the end of the quarter and over the last three years, the market has traded lower 11 of the 12 days. In the absence of news, the market is likely to favor the bearish side the rest of the day.

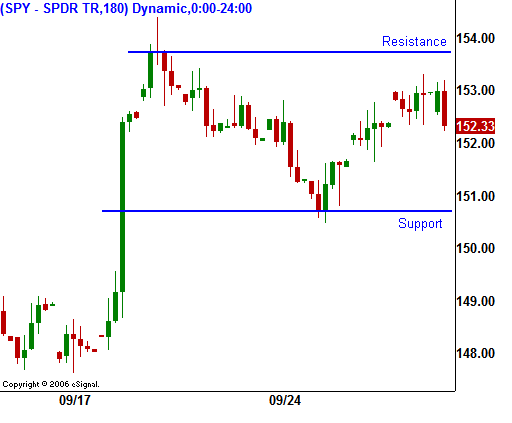

Trading volumes have dropped off as the market waits for news. In today's chart you can see a trading range that I have referenced this week. We are stuck right in the middle of it. There won't be much of any news for the market to sink its teeth into next week. On the earnings front, PEP and WAG will announce early in the week. From Monday through Thursday we will get the ISM reports, housing starts and auto sales. All of these events lack any punch.

A week from today, the picture changes dramatically. The Unemployment Report was the catalyst to the Fed’s action. If the employment number comes in weak, the market will sell off. If last month’s numbers were an aberration and the employment picture looks stable, the market will rally to a new high.

My gut tells me we are heading higher. Since it’s not a reliable indicator, I will continue to be long commodity stocks (agriculture, metals), select tech stocks (semiconductors), and ADRs (Chinese). These stocks will hold up relatively well during a decline. I am also short retail (department stores) and other domestic consumer stocks (household).

Look for a quiet day with a slightly bearish tone.

Daily Bulletin Continues...