Daily Option Trading Strategy

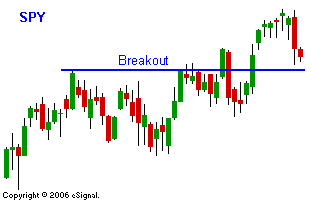

Friday the market opened in a lackluster manner and it seemed like a yawner might be served up. By late morning that changed and the market was in a full blown decline. The sub-prime warnings from HBC and other lenders weighed heavily on financial stocks. When Micron (MU) announced higher DRAM and NAND inventories would cause pricing pressure, the tech stocks joined in. "Merger Monday" has been a non-event. The market is trying to work its way lower, but it lacks punch. I believe that the market will rally into the afternoon if the bears can't push prices lower. All eyes will be on the Fed Chairman as he delivers his Humphrey-Hawkins speech. Given the comments from Fed officials last week, I'm expecting a market friendly reaction. The SPY is trying to test the breakout. As long as it stays above the blue line, stay long.

Daily Bulletin Continues...