Tuesday’s Option Trading Strategy – Capitulation!?

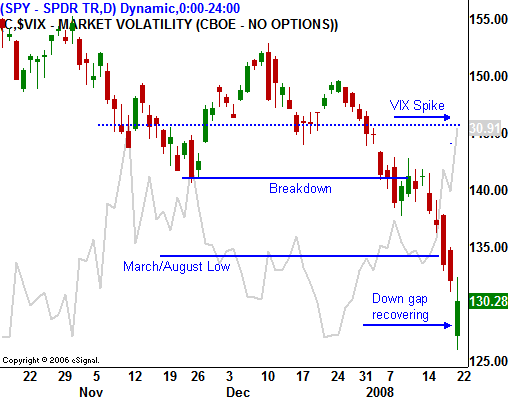

Panic hit the stock market today and everyone is wondering if this is the capitulation we have been looking for. I believe it is and your option trading should focus on put selling.

The market needed to tank in the midst of a downtrend and that has happened. Overseas markets were down as much as 8% during our holiday. I created panic selling.

Before the open, the Fed realized that action needed to be taken. They lowered interest rates by a dramatic .75%. The market took comfort in fat long awaited him ease. Our market found immediate support and it rallied off of the lows.

It is still too early to tell if this is a capitulation low. Trading in the last half hour will provide us with the answer. If the market is able to recover from today’s drop, short term support has been established. Ideally, you’ll also see a follow through rally tomorrow.

Here are the reasons I believe we will see support today.

.

.

1. The Fed lowered interest rates by three quarters of a point.

2. Retail and financial stocks are bouncing. They have been the weakest sectors and the sellers are exhausted.

3. The rest of the week we will get a broad mix of earnings and I believe they will be solid.

4. The FOMC still meets next week and further action could be taken at that time.

5. There is talk that be initial fiscal stimulus package is being beefed up.

6. The European markets rallied sharply, closing near their highs.

7. The market has already reached an oversold condition.

8. Good stocks have been sold off hard to meet margin calls.

.

.

While these are all valid reasons, you can never underestimate the power of fear. I am expecting a sell off this afternoon to shakeout the “bottom pickers”. Then I am expecting a rally into the close. Tomorrow’s price action will be dependent on overseas markets. Unlike most analysts, I am not expecting the ECB to lower rates. I do feel that they might change their bias from hawkish to dovish.

In this environment, you should focus on selling puts to take advantage of the high implied volatilities. If you are playing a short-term bounce, buy the stock. The bid/ask spread is much narrower and you can get in and out with ease.

.

.

Daily Bulletin Continues...