Option Traders Need To Watch Earnings and The ECB

Today, the stock market is testing the downside and there don't seem to be any driving forces to justify the move. It could just be nervousness after the weak GDP and unemployment numbers last week. Option trading should focus on buying strong stocks in a long term uptrend. Don't bee fooled into buying weak stocks that are bouncing - those stocks will soon make good shorts.

To a large degree, the Fed factored that data into its rate cutting decision. The market should take comfort knowing that the Fed is being proactive. If conditions worsen, they know that another rate cut will be considered. These dramatic moves by the Fed are not meant to immediately stimulate consumption. That impact will not be felt for many months. The 1.25% rate cut in an eight day period telegraphs the dire credit conditions faced by lenders. The possibility of a domino effect that could lead to more foreclosures still looms.

The magnitude of the problem could be enormous and the transparency is poor. That is keeping the pressure on.

Our economic releases are fairly light this week. That is actually a positive for the market since it won't have to shoulder more bad news. Perhaps the biggest event of the week is the ECB (European Central Bank) meeting. They will reveal their monetary policy. I expect them to keep interest rates the same. At their last meeting, they actually had a hawkish bias. Today, European inflation came in a relatively hot and it is unlikely that the ECB will lower rates.

If they stand pat, the LIBOR rate will stay relatively high. That is the true cost of capital for many corporations. It will also keep the differential between US interest rates and European interest rates very wide. That in return will pressure the dollar.

There are also concerns that the ECB's stubbornness could lead to an economic slowdown in Europe. That would certainly impact the global expansion theme.

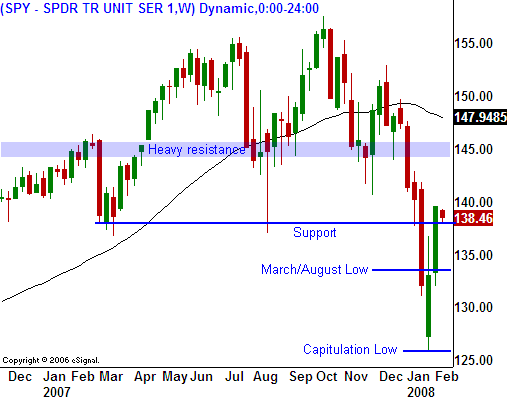

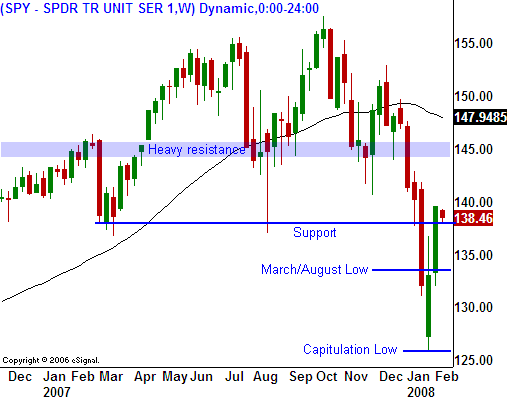

We will have a good mix of earnings this week. So far, they have been decent and the guidance has not been bad. The capitulation low from two weeks ago should hold and the market will take comfort knowing that there are buyers at a lower level.

The Microsoft/Yahoo takeover last week should also stop the bleeding in the tech sector. A deal of this magnitude signals that there are values at this level.

Stay long the strong. Stick with commodity stocks and some selective tech issues. Avoid stocks that are in a long term downtrend and have recently bounced.

Foreign markets were generally strong overnight and I believe the market could rally back near the close. We have fallen into a tight trading range today. If the SPY breaks below 138, we will drift lower into the close. If the SPY trades above 139, we will move higher into the bell.

Daily Bulletin Continues...