Market Stable During Fed Speak – Bullish Sign.

Economic weakness lies ahead and the Fed is ready to lower interest rates if needed. That is the message Chairman Bernanke is sending to Congress as he testifies before them today.

The market does not like to be reminded of the subprime crisis and it has been probing the downside all morning. That said, the damage has been relatively contained. I mentioned earlier in the week that option expiration could be "a fly in the ointment". The market was trading at the low end of its one-month range and sell programs could have materialize.

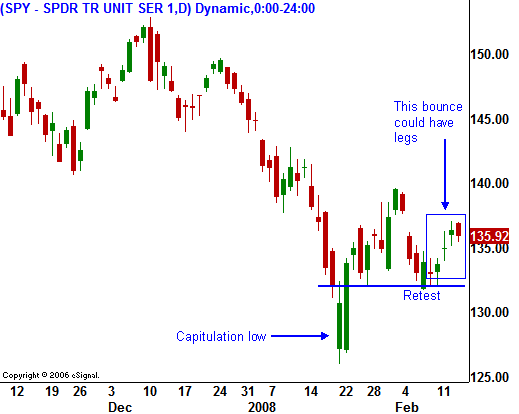

As the week unfolded, prices firmed up and the bears were unable to capitalize on the opportunity. In the chart you can see the capitulation low and the initial snap back rally. That first rally failed and support at SPY 132 was retested. The market has successfully rebounded from that support level and I believe this leg of the bounce could test SPY 144 before it runs out of steam.

Many beaten down sectors are showing signs of life. Financial stocks lost $25 billion last quarter. While that is a huge number, it equals what they made in the same quarter a year ago. When you consider that they simply gave back what they made, conditions don't seem all that dire. If you strip financial stocks out of the S&P 500, earnings growth this quarter has been 11%. That is a good number and it shows that across all sectors, profits are strong.

I am not ready to jump on the bullish bandwagon, but on a short-term basis I do see upside opportunities. Even the decline this morning seemed rather subdued and I would not be surprised to see a rally into the close.

Get long energy, agriculture, metals and technology that has strong growth and strong balance sheets. As the market moves higher, take profits.

Daily Bulletin Continues...