The “Bid” To The Stock Market Is Slowly Coming Back.

This has been a rather lackluster week in many regards. The economic news has been relatively light, the earnings releases have generally met expectations and the market has moved slightly higher.

During the week, Warren Buffett made a lowball bid for the best assets held by bond insurers. He has not had any takers, but at least it shows that capital is waiting on the sidelines. If a major player makes a lowball bid on risky assets, it will establish a floor to a potential damage. I don't see that happening until there is a greater transparency. However, if the government wants to restore confidence, it could fill this void. That is not going to happen either since you can win more votes by dropping money out of helicopters.

President Bush signed the $168 billion stimulus package this week. Loose fiscal and monetary policies have the printing presses running at full speed. Interest rates have dropped, but mortgage rates have not. Lenders demand a risk premium as economic conditions deteriorate. Consumers sense that trouble lies ahead and a lower Fed Funds Rates is not driving them to the malls. After all, credit card interest rates are still high and default rates are on the rise. All lenders are demanding a higher risk premium. People are likely to use the stimulus package to pay down debt and it will not have the desired affect.

This week, the Fed Chairman stated that economic conditions are deteriorating as he testified before Congress. He also said that the Fed is ready to take action if need be. The market declined, but the selling was rather contained.

I view this as a positive development. In prior weeks, negative "Fed Speak" would have led to a nasty day of selling. The market started the week near the low end of its one-month range and that meant that option expiration sell programs could have pushed the market much lower. The bulls were able to mitigate the damage and the bears missed a prime opportunity. All of this tells me that a “bid” had returned to the market.

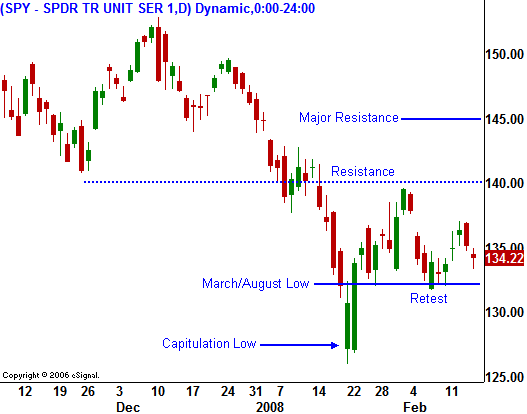

As I mentioned last week, if you strip out financial stocks, S&P 500 companies have posted an 11% earnings growth rate this quarter. That demonstrates solid performance in the other 83% of the index. This week, the market was able to rally above SPY 133. That is a successful retest of a major horizontal support level that resulted from the March and August lows last year. I believe the market will begin a sustained rally that could reach SPY 144 before it stalls. It might take a weak or two for that to start, but I feel we are close. The key is SPY 133. If that level fails, all bets for a rally are postponed.

On an intermediate basis, I believe we are range bound (SPY 130 – 145) for at least the first half of the year. There will be many opportunities on both sides of the market.

Daily Bulletin Continues...