Wait For a Breakout – Then Trade Options.

I am going to keep my comments very brief today. There are a number of cross currents and the market is directionless. As far as the bulls are concerned, that is a positive since the market has stopped going down. If it can mark some time here, a support level will be established.

Inflation is hot, economic activity is slowing, the Fed is lowering rates and earnings (with the exception of financials) are very solid. These driving forces are creating volatility and the charts reflect nervous trading.

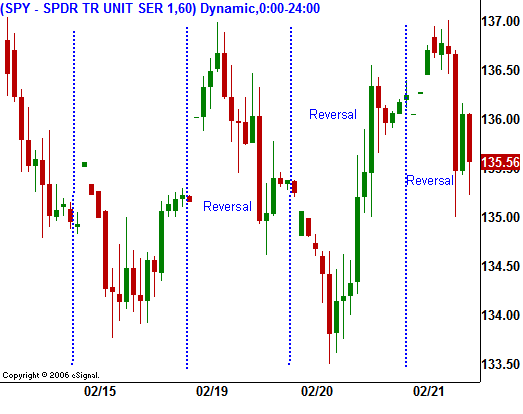

In the first chart you can see that a wedge has formed. This market will either break out or breakdown in the near future. In the second chart, you can see how choppy the action has been in the last 5 days. Almost every opening move has reversed by midday. Yesterday, it seemed like the bears would be in control. When they were unable to push prices lower, the market rallied and it actually finished with a nice gain.

Stay long energy, agriculture and mining. If the SPY closes below 133, get flat and evaluate.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.Daily Bulletin Continues...