Weakness Ahead Will Set-up Option Trading Opportunity.

This has been a relatively tough week for the market and it has gradually given back most of the gains from last week. The bulls tried desperately to survive the "Chinese water torture" as bad news dripped on their heads all week.

Alcoa missed their earnings and reported a 50% decline in net income. Advanced Micro Devices projected revenue will fall below its expectations and it said it would cut its workforce by 10%. UPS lowered guidance and it now expects to make $.86 per share, down from $.96 per share. This stock is widely considered an indicator of economic activity. GE missed its earnings on Friday and that could telegraph problems for other industrial stocks. Financing issues were to blame and the company did not pre-announce because they materialized late in the quarter.

On the economic front, pending home sales fell by 1.9% in February (that indicator is considered to be a reliable predictor of existing home sales). Retail sales were disappointing and the deep discounters were a marginal pocket of strength. Today we learned that consumer confidence hit its lowest point in 25 years. The only bright spot was a drop in initial jobless claims. However, given last week's horrible Unemployment Report, I would not give it much credence.

The IMF estimates that on a global basis the subprime crisis will reach $1 trillion. To date, $200 billion has been charged off. They also forecast that weak economic conditions will exist through 2010. Based on the FOMC minutes that were released this week, we learned that the Fed believes we are in a recession.

Next week, we will get an onslaught of economic news. Retail sales, PPI, CPI, industrial production, housing starts, the Beige Book, LEI and the Philly Fed are among the releases. The market has been able to shoulder most of the bad news, however it feels very tired. Higher inflation and slowing conditions will weigh heavily on the psyche of investors.

Earnings will take center stage and they are dominated by financial stocks. NTRS, STT, WFC, MER, COF, ZION and C are set to release. After last week's write-downs at UBS ($19B) and Deutsche Bank ($4B), I am expecting more of the same. GE's escalating problem late in the quarter concerns me. Financial institutions have been feverishly beefing up their balance sheets with fresh capital and perhaps they are experiencing the same. I suspect that they will post weak results and they hope that the additional capital will reassure investors.

Other earnings releases that are of interest include: BHP, JNJ, CSX, ABT, KO, EBAY, IBM, SPWR, GOOG, CAT, HON, and SLB.

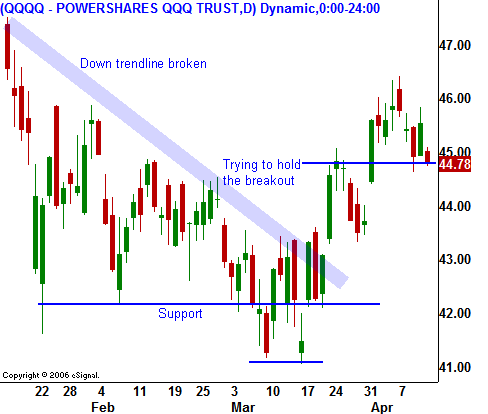

I believe the market will be caught in a trading range for the next few months. That range could extend from SPY 126 – 143, however it is likely to stay between 128 – 138. There is not enough good news to push it through the intermediate resistance level at SPY 138. The Fed has aggressively added enough liquidity to avoid a financial collapse and the double bottom will hold. Next week's price action should be relatively weak. If the market continues to drift lower option expiration could exacerbate the move. Once the financials have reported, the market has a chance to rally. I still like commodity stocks and I am in the “buy the dip” camp.

Next Wednesday (April 16th) at 9:00 pm ET, I will be hosting a FREE online event. This is your chance to learn a new approach to option trading and to get scores of trading ideas. I will start by introducing my methods and then I will use my Scanner to look for new trades. The presentation will culminate with a review of my bullish and bearish watch lists. I will show attendees the Live Update page and we will flip through the charts. I want you to see how well the Daily Report has performed. Please view this video before you attend.

To keep the experience unique and to guard my research, I will not be recording the event. If you can’t attend, I will schedule other events in the future. If you can attend, Register now!. Space is limited.

Daily Bulletin Continues...