Line Up Stock Option Trades – Resistance Could be Challenged Soon.

Yesterday, stocks shot higher on sound earnings news and a "contained" CPI. The focus this week is clearly on financial stocks. Worst case scenarios are factored in and stocks have avoided major disasters. Relief rallies have resulted, placing an underlying bid to this market.

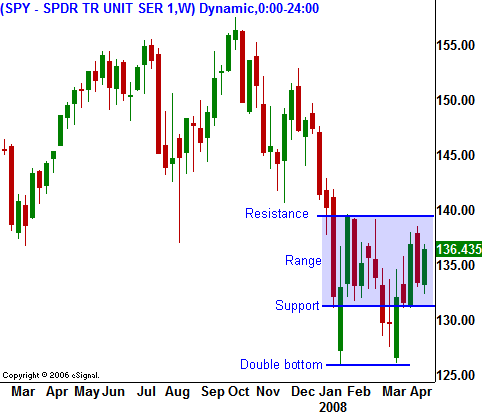

Once yesterday's rally got traction, short covering and expiration related buy programs helped to fuel it higher. The market is a little ahead of itself and profit taking a setting in today. The SPY 138 level is proving to be a formidable. Conversely, support at SPY 132 has been impressive and we have seen two large gaps up from that level in the last few weeks.

Overseas markets were generally mixed and they did not provide much direction for us this morning.

Economic news yesterday included weakness from region-to-region across the country. The Beige Book created a moment of weakness after the release and then buying set in. Once again, when the results weren't quite as dire as expected, the market rallied on the release. With regards to this week's inflation numbers, a hot PPI that does not translate into a hot CPI means that producers are absorbing the cost increases. Consumers are tightening their belts and they are not willing to pay higher prices. Ultimately, this will hurt profit margins next quarter.

This morning, initial jobless claims rose to 372,000. That is right in the middle of the three week range. In general, I would view that as an acceptable level and it was below expectations. The spoiler to this recent market rally would be higher unemployment. If more Americans lose their jobs, the second wave of the credit crisis could begin. The Philly Fed index was much weaker than expected and that could be weighing on the market.

On the earnings front, IBM released a fantastic number and it has broken out above resistance. EBay also beat expectations, but not because of its auction business. The market was less enthusiastic about this earnings report. United Technologies posted a 22% growth in profit. On the negative side, Merrill Lynch announced a bigger than expected loss and they might raise more capital. It is writing down $4.5 billion and it is also cutting 4000 jobs. Pfizer also missed their number.

After the close we will hear from AMD, GOOG and SNDK. The semiconductors have been relatively weak and I believe they will continue to flat line after the number. GOOG could surprise to the upside. There has been so much negative news built into that stock and I feel its lower click through rates could be explained by a change in algorithm. If that is the case and lower click through is not due to a "soft patch" in online advertising, the stock could jump higher. COF and ZION will also release earnings this afternoon, but given the price action in the financials, I feel that even marginal performance will keep these shares afloat. Tomorrow, before the open, CAT and HON will announce. It will be interesting to see if the financing woes that hit GE will also impact these two companies. We will also get our first glimpse at the profitability of oil services companies when SLB reports.

Overall, I believe the market has overcome what could have been a very tough earnings week. I believe the bid continues to grow and pullbacks of any magnitude are buying opportunities. I still feel that we need to get through next week unscathed to have a chance at taking out intermediate resistance at SPY 138.

Next week, in addition to all of the earnings reports, we have the FOMC and the Unemployment Report. For this afternoon, I expect the market to find support. Most of the option expiration fireworks are gone and I believe that a relief rally could set in. The volume is fairly light today, trade small.

Daily Bulletin Continues...