Keep Option Trading Light In This Choppy Market

Yesterday, the market declined on news that Standard & Poor's lowered its rating on banks and brokerage firms. The rating agencies have completely butchered their risk assessment of this sector and they continue to be one step behind. The financials will have many months of hardship, however I believe that they are compressing down to a support level. The Fed has been extremely accommodative and the worst is over. This is still my favorite sector to sell OTM call spreads so don’t interpret my assessment as bullish.

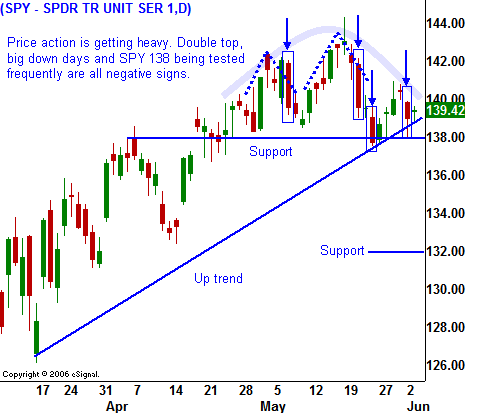

In short order, last week's gains were almost erased by Monday's decline. In the chart, you can see the growing number of down days. The market feels very "heavy" and it is starting to roll over. If the SPY 138 level fails, we are likely to test the 133 level.

There is not much news to drive the market today. Yesterday's decline may have been a little overdone and lower oil prices are giving the market a boost today. Tomorrow, the ADP employment index, ISM services and crude inventories will provide some action. The ADP employment index tends to overstate the employment scene and it could generate a spark. The ISM services number has rebounded nicely from the February lows and it has been above 50, which represents growth. Finally, last week oil inventories dropped and so did oil. This tells me that a decline in oil inventories might not result and higher energy prices. A rise in inventories could generate an oil sell-off. In short, I believe tomorrow's numbers will have a positive bias.

The biggest number this week will be the Unemployment Report. Initial jobless claims have been averaging 372,000 for the last three weeks and that number should translate into a benign Unemployment Report. As long as unemployment does not rise, I believe the market has a chance to rally.

The price action will remain choppy this week and you should sell OTM calls spreads on stocks with relative weakness. It looks like the market will continue to work its way higher today in light volume.

Daily Bulletin Continues...