Dead Till The Fed – Keep Option Trading Size Small – Favor the Downside!

Wednesday, the market opened lower and it continued to decline throughout the day. A number of negative events this week are creating selling pressure.

The PPI came in "hotter" than expected and food and energy are to blame. Food producers have not been able to raise prices enough to offset rising costs and profit margins are down. Wednesday, FedEx substantially lowered guidance for the entire year. They have passed on higher fuel costs by adding surcharges; however, the price increases have softened shipping demand. They have forecasted a struggling economy. A spike in the PPI without a corresponding move in the CPI translates into lower profits.

Around the globe, central bankers are tightening monetary policy and interest rates are headed higher.

Next week, the FOMC will meet for a two day session and they will make an announcement on Wednesday. Many of the Fed officials have hinted that rates will be going up. I am not expecting a hike this month, but I believe the comments will suggest future increases. For the time being, the Fed needs to digest weak economic data. The unemployment rate made its biggest jump in 22 years last week. Today, initial jobless claims rose and continuing claims are still above 3 million. The NY Empire State index, housing starts, industrial production and the Philly Fed index were all below expectations this week. Another huge round of mortgage resets is taking place over the next few weeks. The interest rate on mortgage loans rose 33 basis points last week and that will weigh on homeowners. I believe the Fed is concerned about inflation, but they want to see the ripple effect from these mortgage resets before they raise rates. The no-action decision might generate a rally, but as long as oil maintains its current level, it will be short lived.

Food and energy prices will remain high this year. Floods in the Midwest and a late planting season will push grain prices through the roof. Currently, the global demand for oil is 86.5 million barrels per day and 85 million barrels are being produced. As long as the demand outstrips the supply, prices will stay high. "Saber rattling" over Iran's nuclear facilities is also adding a risk premium to energy prices. We are in a La Nina weather pattern and an active hurricane season has been forecasted by meteorologists. That is also keeping oil prices high. One good piece of news is that China announced today that they will stop subsidizing oil prices. They are the second largest consumer of oil in the world and rising prices will decrease consumption. This move was not expected until after the Olympics. On a short-term basis, oil could head lower and that will shake out some of the speculators. Long-term, the fundamentals are in place for high oil prices.

Financial stocks are still weighing on the market. Goldman Sachs posted solid results, but they are the exception, not the rule. Morgan Stanley announced dismal results and today they revealed that a "rogue trader" will cost them another $120 million as they marked down those positions. FITB will need to raise $2 billion and they are cutting their dividend by over 60%. The regional banks continue to get pounded.

Next week the market will digest consumer confidence and durable goods before the FOMC statement. Later in the week GDP, initial jobless claims, personal income and the PCE inflation index will be released. The earnings releases are very light and in all likelihood, it will be "dead till the Fed". The remainder of the week, the market will trade off of the Fed's statements.

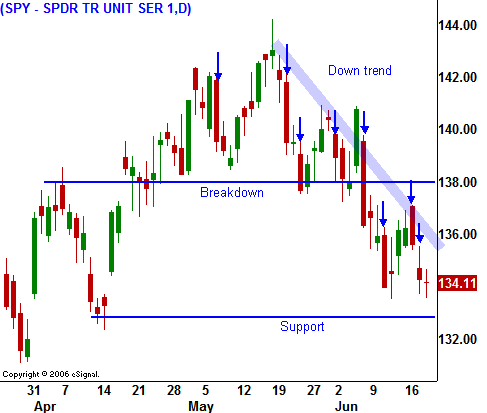

On a technical basis, the market is in trouble. Since trying to break through heavy resistance at SPY 144, we have been in a steady decline. The number of big down days is increasing and we broke below horizontal support at SPY 138. If the market breaks below SPY 132, it might test the lows from March in the next few months. I am selling OTM call credit spreads on rallies and that strategy continues to serve subscribers well. Keep your trading size small and favor the downside.

Daily Bulletin Continues...