The Market Is Poised To Drift Lower All Day – Be Patient In No Man’s Land!

From a trading standpoint, this is a great week to play golf, catch a good movie or watch the Olympics. The market is chopping around in the absence of material news and it is directionless.

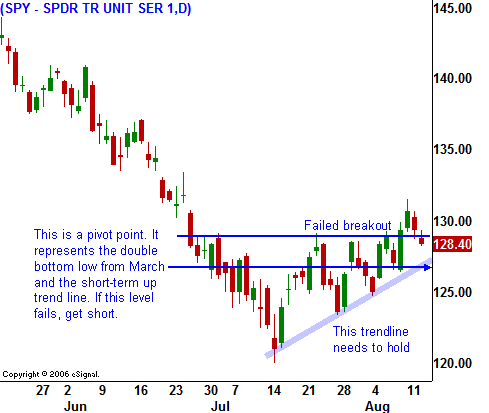

Earlier in the week, we tried to breakout above SPY 129.50. We did so briefly only to give those gains back yesterday. New concerns in the financial arena scared investors and the SPY closed below that short-term support level. For the time being, the uptrend line I have drawn in today's chart is still intact. The market has been able to make higher lows and that is bullish. However, push is coming to shove and we will need to see a breakout above SPY 130 soon.

Today, a number of the economic releases are weighing on the market. Retail sales dropped .1% and auto sales were to blame. Business inventories rose .7%, up from .4% last month. Import prices rose by 1.7% and they have increased 21.6% over the past year. Much of that is related to a 79% increase in oil prices, but a weak dollar is also at fault. Overseas, Japan's GDP declined by .6% and bulls are fearful that a global slowdown will delay any hopes of a rebound in US economic activity.

A drop in oil and lower commodity prices should have sparked a bigger snap back rally than we have seen. The market is very comfortable at its current level and light trading has set in. Global interest rates have stopped going up as economic conditions deteriorate. Inflation should slow down as commodity prices ease and that will also reduce the need for monetary tightening. Earnings on the S&P 500 are down 20% compared to last year. However, they could improve as input costs decline. Earnings and interest rates drive the market and right now we are in a “wait and see” stalemate.

If the market breaks below SPY 126, I will start taking short positions. That is a critical level since it represents the double bottom low from March and it represents a breach of the uptrend line. If the market can close above SPY 130, short covering will spark a rally.

Tomorrow, the CPI is likely to come in "hot", but I think the market will be able to recover quickly from the initial reaction. That number is backward looking and it does not factor in the current decline in commodity prices. Last week, we saw a similar reaction to a "hot" PCE number. Retailers are reporting fairly weak results and that could be a problem as the tax rebate stimulus has run its course. I believe the retail sector has room for a decline.

The market IS poised to drift lower all day. The A/D is a negative 1:2, we have broken below SPY 129.50 and the momentum has shifted to the downside. Furthermore, option expiration sell programs will materialize if persistent selling sets in. We are in “no man’s land” between SPY 126 – 130. KEEP YOUR SIZE SMALL AND WAIT FOR A BREAKDOWN/BREAKOUT.

Daily Bulletin Continues...