The Momentum Is Down – Don’t Buy Today’s Rally!

This morning, stocks are trying to recover a from a three-day 40-point slide in the S&P 500 futures. Financial stocks are at the forefront and further weakness is expected. Analysts are projecting many bank failures and financial institutions are downgrading each other. Fannie Mae and Freddie Mac are scrambling to secure much-needed credit.

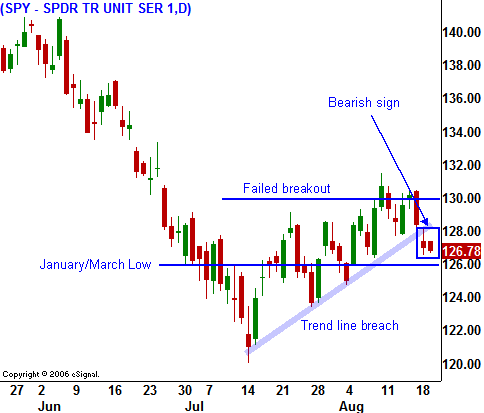

Last week, the market tried to rally above minor horizontal resistance at SPY 130. It briefly held that level and bulls were timidly buying stocks as commodity prices declined. The market has broken the small up trend line that started from the July lows and that is bearish. This rally was very wimpy and I believe the market will soon take out SPY 126 support. If that happens, it will test the July lows. We are heading into a very weak seasonal period that lasts until the middle of October.

Oil prices are firming up and Goldman Sachs raised its price target to $149 per barrel. This morning, oil inventories were much larger than expected and contrary to what you might expect, oil is trading higher. Yesterday's PPI number showed a big increase in core prices. Rising inflation combined with a slowing economy could be lethal.

Global economies are slowing down and China is no exception. After the Olympics, they are likely to suffer a "hangover". The Chinese government is considering a stimulus package to soften the blow. This news rallied their stock market 7% overnight and it temporarily stopped a steady decline.

Good news is hard to come by and investors are scared. Stocks have been pushed down to attractive valuations, but no one wants to step up to the plate when there is so much uncertainty. These events explain the tight trading range.

Tomorrow's initial jobless claims number is likely to weigh on the market. Unemployment has been steadily climbing and the continuing claims are over 3.2 million. If my suspicions are correct, the market could break below SPY 126 tomorrow.

I don't trust today's rally.

Daily Bulletin Continues...