Sell OTM Put Options – Distance Yourself From The Action!

Yesterday, the market started off on a weak note and it never recovered. The gains from Friday afternoon and Monday have been erased and the market is struggling to hold a bid today.

Given the big decline right on the open and the fact that we have not seen a decent bounce in the first two hours tells me that more trouble lies ahead this afternoon. Good news is overpowered by bad news.

After the close Tuesday, Yahoo and Apple both announced earnings. Yahoo beat lowered estimates and they plan to lay off 10% of their workforce. Apple beat estimates handily and the stock is currently trading $8 higher. McDonald's was another earnings bright spot. Interbank spreads continue to decline, indicating that lending conditions continue to improve. They still have a long way to go. That’s it for the good news.

Regional Banks have been posting weak numbers, but they are not as dismal as the results posted by Wachovia this morning. The bank lost $24 billion last quarter. Most of the damage was sustained from their $25 billion purchase of Golden West Financial. The loan/equity value has risen from 70% to 90% in the last year and that is concerning. It shows that they are nearing a negative equity situation on their mortgage loans.

Nearly one out of every six homeowners is finding themselves in a situation where their house is worth less than their mortgage. Nearly 12 million US homeowners have negative equity and that compares to 6.6 million at the end of last year.

Drug companies have always been considered a safe haven. The results in this sector are poor and this is not a place to park money. Many major drug companies have missed earnings estimates. Merck is cutting 12% (6800) of its workforce and its quarterly profit fell 28%.

Asia was hit hard and the Nikkei was down almost 7%. Europe was down 5% on average and a dark cloud was cast before the opening bell rang.

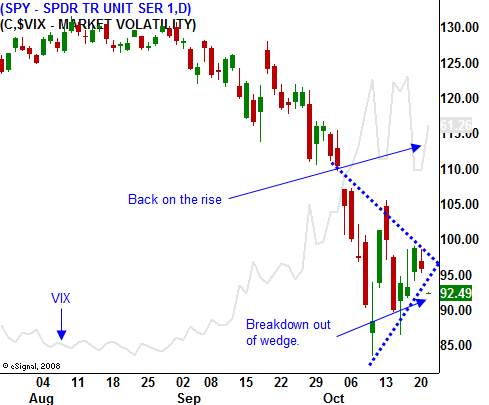

The credit crisis is still a concern, but the market has shifted its attention to earnings and deteriorating economic conditions. We are still one bad day from testing the lows at SPY 85. The fact that we can't generate buying from a deeply oversold condition has me wondering if a snap back rally is in the cards. There are currently too many sellers that want to unload stocks on the first rally.

You still can't touch this market with a 10 foot pole. The only trading strategy that makes sense at this level is to sell naked puts on strong stocks. Look for companies that have a strong balance sheet and are not dependent on financing or economic strength. Many of these have formed a solid base and the put premiums are high. Sell OTM puts below support and buy them back in if support is breached.

This market has the potential to swing either way and that is why I want to distance myself from the action by selling OTM puts.

Daily Bulletin Continues...