The Market Feels Heavy Today – Stay Long – Use Stops.

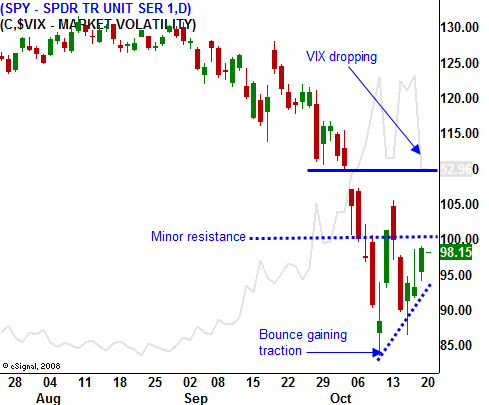

Yesterday, the market started off on a positive note and it rallied throughout the day. The SPY 100 level represents minor resistance. If we can break through that, I believe we will test the 110 level by the end of the month.

Credit markets are easing and the spreads are coming in. The actions by central banks around the world are starting to take hold. Confidence is on the mend and banks are lending money to each other. We were very close to a full-blown financial collapse and that reality will keep banking officials on their toes.

A financial collapse would have been devastating. Fear and chaos would have resulted. Consequently, until the credit crisis was resolved, nothing else mattered.

Long –term, the market is headed for trouble, but that decline is likely to materialize over an extended period of time. There will be support levels along the way and we will have time to evaluate the situation. An orderly trading pattern will set in and earnings/economic news will once again drive the action.

The economic news is light this week, but we have earnings galore. After the close we will hear from Apple and Yahoo. Overall, earnings have been decent. The market has more than discounted bad news. I feel that as each number is released, there will be a sigh of relief and confidence will build.

The VIX has started to back off and the market has been able to rally from its low last week. The last week of October and the first week of November are typically very bullish.

I expect this rally to last at least a couple of weeks. Hedge fund liquidation and the fear of financial collapse pushed the market into a deeply oversold condition. Shorts will start to cover and that will also fuel the rally.

The market feels a bit heavy today and I expected to grind back to unchanged by the end of the day. The first week of a five-week expiration cycle tends to be lackluster and we are likely to see back-and-forth action. Favor the long side and avoid earnings plays.

Daily Bulletin Continues...