The Market Has Lost 15% This Week – Choppy Action On Option Expiration!

Yesterday, the market reacted negatively to the "Big Three" bailout postponement. Republicans and the Bush administration would have rejected the proposal and Democrats knew that more information was needed. They demanded a business plan from General Motors, Ford and Chrysler.

The bridge loan will be contingent on a viable strategy from each automaker and politicians don't want to throw money into the air. The CEOs were not able to answer many important questions and they did little to instill confidence. In my opinion, labor negotiations need to start immediately and executives will have to make wage concessions. Production timelines and economic forecasts will also be critical. Each of these companies has a team of economists, yet the CEOs were all clueless when asked about future conditions. My suspicion is that they know they are in deep #$%^ and that $25 billion will barely wet their whistles.

GM and Ford are burning through $5 billion a month. GM has been able to mask its production by expanding the number of dealerships. They have over 7000 dealerships and their market share is slightly higher than Toyota who has 1200 dealerships in the US. This allowed General Motors to crank out cars. They had no other choice; the UAW would receive 90% of their pay if they were laid off. Consequently, they decided to keep producing. What horrible labor negotiations!

Walk onto any car lot and you are likely to be mugged by a salesperson. In Long Beach (the nation's second largest port) cars are piling up like cord wood. Dealers don't have any more room on their lots and the Port Authority doesn't know what to do with new shipments.

It takes five years for an automaker to retool. Even if an electric car came off of the line today, why would anyone buy it? Gasoline prices have tanked and you can get a good deal on a gas guzzler. That inventory needs to be worked off and it will take many years given the current glut of autos. Unfortunately, willing buyers are hard-pressed to get financing in these tight credit markets.

Do car makers sound like a good investment? Apparently they are not. The "Big Three" are reinvesting their overseas profits into overseas production. They see that as a better use of capital. Why not stick the American taxpayer for poor business decisions? The government already has its wallet open and the "too big to fail" ploy seems to be working for everyone else.

The "Big Three" will present best case scenarios so that Congress can feel good about the bailout. Six months from now, they will return for more money claiming that "unforeseen circumstances" foiled their plan. That's when the finger-pointing starts. Taxpayers will have sacrificed $25 billion and the reality will set in. These companies were failing during the best of times and their model is doomed.

I feel sorry for all the families that are affected, but I hope they saved money while they were making $74.00/hour (average pay). I know that union workers are punching in right now and they are making that kind of money while they watch movies all day. Production has been cut back and there is not enough work. I’m trouble by the thought of paying someone $74/hour for the next 3 years while this car glut gets worked off. I sense that other Americans are ticked off too.

There will be many other failures and that is just part of the cleansing process. Recessions weed-out inefficiency and the strong survive. If we subsidize weak companies that make poor decisions, capitalism will fail.

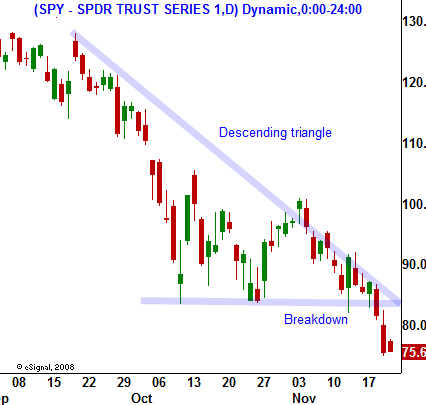

Sheer panic has hit the market and the decline this week has been exacerbated by option expiration. We broke key support at SPY 85 and the selling accelerated.

There are many long-term issues that need to be resolved. I have been selling out of the money puts on stocks that have defined support (this means they are above their 52 week lows) and are fundamentally strong. The best strategy is to sell short into the one day rallies. As the market drifts lower, take profits and go to cash. Keep repeating this process. Puts are extremely expensive and shorting stock is the way to go.

Bears tried to push the market down after an initial rally. Their effort failed and we should see a rebound throughout the day. Overseas markets were relatively strong and they did not decline to the extent that our market did yesterday.

Next week, the earnings and economic news is fairly light. In a holiday shortened week, volatility should subside. In two weeks, the Unemployment Report will weigh on the market.

Daily Bulletin Continues...