The Market Should Close Near The High Of The Day – Sell OTM Put Spreads!

Yesterday, the market was able to close in positive territory. That is a good sign and a bid has materialized. After a nasty decline a week ago, the market opened lower Wednesday, Thursday and Friday. Each of those days the losses were erased. The market has follow-through and the price action is bullish again today. Advancers outnumber decliners by a 2 to 1 ratio and I believe we will grind higher into the close.

Most of the financials have reported and some of the fear has been removed. Today, Zions Bank reported decent earnings and it demonstrates that within the financial sector there are well-managed banks.

Approximately 20% of the S&P 500 has reported and 9 out of 10 sectors have missed earnings estimates. The market is priced for disaster and that is why it has been able to tread water after the releases.

This morning, steel producers generally posted decent numbers and those stocks are moving higher. The economic outlook for these cyclical giants is not good for the remainder of the year; however, worst-case scenarios are already priced in. This evening, truckers and railroads will be posting numbers. I don't believe the earnings or the guidance will be positive. The airlines are getting pounded today after Delta missed their number. The transportation sector has been beaten down and there aren't any signs of life. There might be room for more downside in this sector. Boeing and Wells Fargo could weigh on the market tomorrow before the open.

The economic news will hit Thursday. Initial jobless claims number is highly scrutinized and the unemployment rate continues to jump. Durable goods orders are expected to be weak and that could also weigh on the market. I am expecting the FOMC minutes to be a non-event. The target Fed Funds Rate is at zero and they won't make statements about their future plans until the President's budget is released in a few weeks.

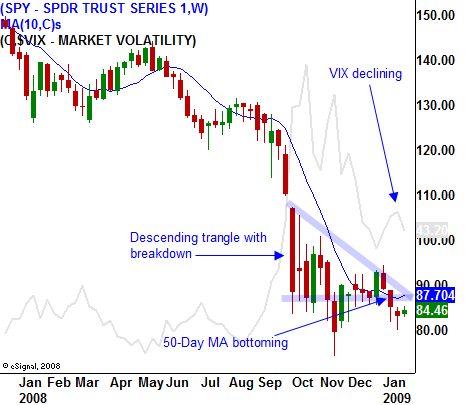

Consequently, I see the week playing out like this. We will see a continued rally this afternoon and the move will stall tomorrow. There's a chance that the market will have to overcome early declines each day the rest of the week. End of month fund buying will help. In the chart, you can see that the 50-day moving average is starting to flatten out and that's a good sign. You can also see the decline in the VIX. A descending triangle has formed in the market has broken support. Today, we need to see a close well above SPY 85 to mute that bearish technical formation.

I like the bid to the market and as I mentioned yesterday, I have been aggressively selling out of the money puts. I have half of my desired risk exposure at this point and I will look for opening pullbacks the rest of the week to add to my positions. I am staying with February options on strong stocks that have released earnings and have good technical support. By the end of the week I should have 75% of my positions on.

Daily Bulletin Continues...