Don’t Look For A Bullish Reversal Today – SPY 85 Needs To Hold!

During last week's inauguration the market tanked. Earnings season was on our doorstep and the first round of news would come from the financial sector. Worst case scenarios were priced in and rightfully so. Massive bank write-downs continue and they have spread from the multinationals down to regional banks.

The table was set last week for a retest of SPY 75, but that didn't happen. Each following day, the market declined on the open and gradually worked its way back. That support followed through this week and the market was able to post four consecutive gains. Yesterday, the market rallied throughout the day and closed near its highs of the day.

The $825 billion stimulus package was approved by the House and now the Senate will vote on it. The concept of forming a “bad bank” gained traction and government officials discussed spending another $1 trillion to $2 to shore up balance sheets. Both events provided a boost to the market and today we have selling after the news.

Overnight earnings weren't good and Qualcomm, Starbucks, Toshiba, Sony, Kodak, AutoNation, Continental Airlines, US Airways, Shell, 3M and Ford cast a dark cloud on the early action. So far 9 out of 10 sectors have missed earnings. The one exception is healthcare.

Amazon releases after the bell and decent results are expected relative to the rest of the retail sector. If the market doesn't like the news, the entire retail sector will falter. Chubb has been stable insurer and we will get our first glimpse at that group. Tomorrow morning, many of the integrated oils announce and lower oil prices are likely to hurt profit margins.

Initial jobless claims increased 588,000 last week and continuing claims are just shy of 4.8 million. The economic slowdown is intensifying in the credit crisis will continue to spread. Durable goods orders dropped 2.6% in December and 3.7% in November. November’s number was revised upwards and consumers are cutting back on big-ticket items. New home sales plunged to the slowest pace on record and they declined 14.7% in December.

Tomorrow, GDP and Chicago PMI will be released. Weak numbers are expected. The most significant release every month is the Unemployment Report. It will be released next Friday and we can expect nervous trading ahead of the news.

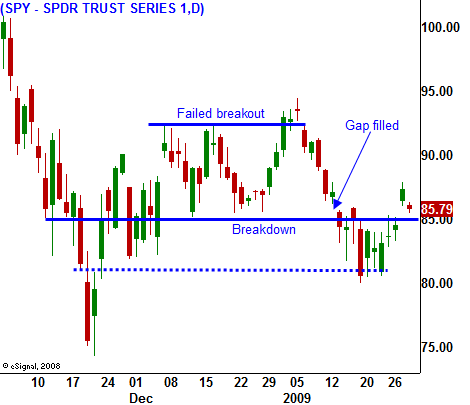

A bid has returned to the market and traders were able to rally the SPY above 85 resistance. That level now represents support and that it needs to hold. I expected a pullback this morning, but I also expected a rebound from the lows and it doesn’t look like we will get it. The news has been horrible the last week and buyers do not have much conviction. Bulls will nibble during deep declines, but they will not chase prices higher. No one seems worried that they will miss the next big rally.

The last four days of January are typically very bullish. End-of-month/beginning-of-the-month buying should support the market. However, it is unlikely to rally back to SPY 91. That is significant because it marks the starting point for 2009. As January goes, so goes the year. This indicator is 91% accurate and it dates back to 1950. I'm long-term bearish and this indicator would only confirm that tough year lies ahead.

I am not seeing the buying that I anticipated and the market feels like it will work its way lower today. Tomorrow's open will likely have a negative bias due to the earnings releases and the economic data. If it can reverse early losses, it has a chance to stabilize going into next week. Bulls will not fuel a rally ahead of the Unemployment Report and the market will do well to tread water until then.

I have been selling out of the money puts on stocks that I like and those positions are working out well. I have 75% of my desired risk exposure and I will not add the remaining 25% until I see how tomorrow plays out. Selling puts is still the best strategy, but you have to be very careful in your stock selection. If the market breaks below SPY 90, I will start reeling in my short put positions.

Daily Bulletin Continues...