European Banks Are A Concern and The EU Is In Danger – The Next Down Leg Has Started!

Last week, the market made new 12-year lows as it digested horrible economic data and it assessed continued problems in the financial sector. Durable goods orders fell 5.2% and business spending was down 5.4%. Initial jobless claims rose to 667,000 and continuing claims rose to 5.1 million. The GDP declined 6.2% in the fourth quarter and business investments dropped by 21%. We have to go back over 30 years to find conditions that were as dire as they are today.

AIG posted a $100 million loss in 2008, $60 billion of it coming last quarter. The government has decided to stuff another $30 billion into the failing giant. Citigroup also needs more money and they are trying to structure a deal with the government. Banks are universally cutting dividends to increase liquidity.

Conditions in Europe are even worse. Over the weekend, HSBC announced that they will need to raise $18 billion in capital. Eastern European banks are on the brink of failure and Latvia and Romania are the first two casualties. They will need additional capital and last week a banking consortium raised $25 billion for a contingency fund. Unfortunately, Eastern European countries have $1.7 trillion worth of loans and it is estimated that they will need at least $200 billion. With all of Europe struggling, it is unlikely that they will be able to raise this capital. Over the weekend, Hungary asked for help and they were flat out rejected by Germany, the largest EU member. This could mark the end of the EU.

If Eastern European banks start failing it will devastate weak European banks and the ripple effect will circle the globe. Overnight, European stocks were down 3.5% on average. Asia was down slightly less. This negative backdrop for pressure on our market this morning and all assets are being devalued.

ISM manufacturing improved slightly from January to February, but the number is still an abysmal 35.8. A number below 50 indicates economic contraction. Analysts are bracing themselves for Friday's Unemployment Report. Payrolls are expected to drop by 648,000 workers in January and that would spike the unemployment rate up to 7.9% from its current 7.6% level. The acceleration of unemployment is of particular concern.

So far, traders are not embracing Obama's plans. The $800 billion stimulus plan has come under fire because it does not create new jobs. Last week, he also outlined the rollout of tax increases to the rich. Corporations are concerned that they will be hit with higher taxes after they learned of his intentions to tax oil companies. We need to encourage oil exploration and his actions will do exactly the opposite. Take away their subsidies, but don't slap them with windfall profit taxes. This is one area where we can create jobs in the US and improve our trade balance in the process. As we cut back on foreign oil, we strengthen our own balance sheet.

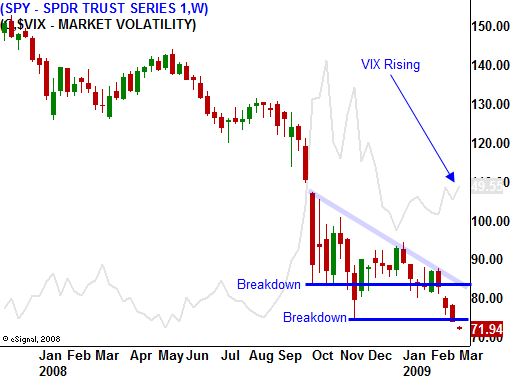

Now that market support has been broken, the next down leg has begun. The VIX is climbing and we might be near a capitulation low. That does not mean I am bullish. It's simply represents a resting point where we can add to our short put positions. I currently only have 25% of my risk exposure on and I'm watching closely. I see many opportunities to sell out of the money puts on good stocks, but I want to be cautious and I want to take in as much premium as I can. There aren't many groups to cling on to. However, I am finding lots of individual names that are holding up well. These companies have strong market share in their niche; they have strong balance sheets and good cash flow. This is a stock pickers market.

While there are opportunities on the short side, I believe they are better suited for day trading. Once the momentum begins, you can short weak stocks and buy them back near the close. Overnight shorts are very risky at current levels. I don't like longer-term bearish positions at this juncture because one good shred of news could rocket this market much higher. Bear market rallies tend to happen just when it looks like things can't get any worse. Consequently, I feel in control when I am selling out of the money put positions as the market gradually drifts lower. I can control my risk in this environment and the moves are relatively predictable. On the other hand, if I'm selling call spreads and I get caught in a bear market rally, it could wipe me out as everyone starts reeling in short positions.

The news is horrible, the decliners outnumbered advancers by 12 to 1 and we have made new 12-year lows. There's no reason to think that we won't drift lower the entire day. If we drop more than 50 S&P 500 points, look for signs of an intraday reversal. If we get one in here, it could spark a short-term rally. It is more likely that we will not see an intraday reversal until Friday's number has run its course.

Daily Bulletin Continues...