Short Term Support Should Last Through Expiration – Don’t Get Long – Sell OTM Puts!

This morning, stocks opened on a positive note. The buying started in Asia and it circled the globe. China's purchasing managers index (PMI) rose for the third straight month. They are increasing their previous stimulus plan by another $600 billion. Copper inventories in London are declining and speculation has it that China is ramping up consumption.

Yesterday, the market tried to rally, but it failed late in the day. There was simply not enough good news to fuel a rally. Today's news is encouraging; however it is way too early to predict a rebound in Asia.

This morning, the ADP employment index came in very weak. Private employers cut almost 700,000 jobs in February versus 614,000 jobs in January. Initially, January job cuts were reported at 522,000. The job scene is horrible and until it starts to improve, don’t expect a sustained market rally.

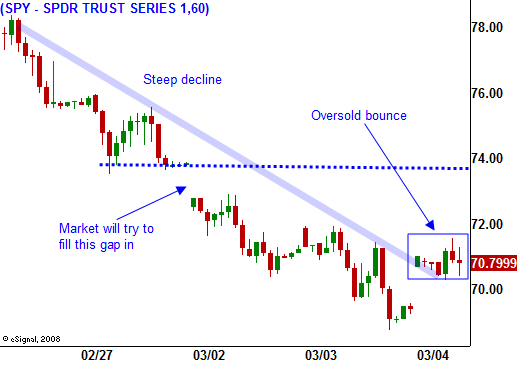

Bears have been trying to keep a lid on this market today; however the momentum should carry it higher. We are in deeply oversold territory as you can see in today's chart. This move is nothing more than a short covering bounce. This sure beats the Chinese water torture we've gone through during the last week, but don’t forget the dire conditions that precipitated the decline.

This afternoon, the Beige Book will be released. It is likely to show economic deterioration across all regions of the nation. That is widely expected and I don't believe it will hamper today's rally. In fact, if bulls are able to pull out some positives, it might add to the rally. The market will try to fill in the gap at SPY 74. It will hit resistance just above that level.

Bulls have learned to temper their excitement. They will not chase this market ahead of major economic news tomorrow (initial jobless claims) and Friday's Unemployment Report. They have no reason to feel like they will miss the next big rally. The issues that weigh on our market will not be quickly resolved and every rally this year has failed.

This is the type of rally that has kept me from entering bearish trades. I am selling out of the money puts and I will continue to add to my position if support holds this week. In particular I like commodity stocks. They are fueling this rally.

I believe this rally could hold and we will have a new short-term support level through expiration. However, I am skeptical of any rally and I want to distance myself from the action. Temper your excitement and don't start jumping into long positions. The bears are still in control and they will not easily be shaken out of positions.

Daily Bulletin Continues...