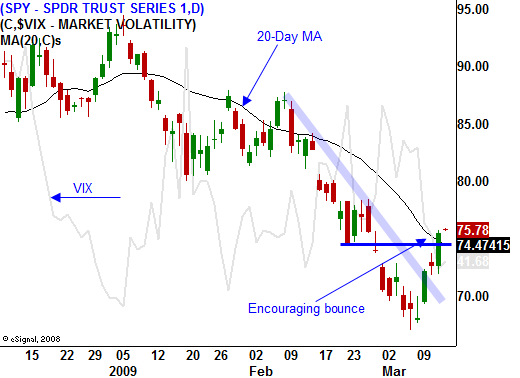

The Bears Will Test The Bulls Today – We Need A Close Above SPY 75 Today!

Yesterday, the market was able to overcome early weakness and stage a nice rally into the closing bell. In doing so, it penetrated key resistance at SPY 75. I believe this move was critical to a sustained bounce and it needed to happen this week.

More good news continues to flow in from the financial sector. Citigroup Chairman Richard Parsons said that the bank will not need any additional capital from the government. Earlier in the week, the bank said that they posted an operating profit of $8.3 billion in the first quarter. This does not include write-downs, but clearly conditions are improving. Banks should be making money given the huge spread between their borrowing and lending rates. Congressional hearings are taking place to discuss changes in mark-to-market accounting rules. FASB, the SEC, the Fed and the Treasury favor changes and any relief could stimulate lending. The financial sector is the key to any sustained rally.

Next week, Goldman Sachs will release earnings and we will see if they can also provide a spark. They are one of Wall Street's best managed firms and they have a history of upside surprises.

FedEx will also announce later in the week and we will be able to gauge economic activity when they give guidance. Transportation and shipping will show the first signs of economic improvement.

There will be many economic releases, but they have had a muted affect. Bad news is expected and it is priced into the market. Consequently, PPI, CPI, LEI, initial claims and the Philly Fed are likely to produce small moves.

Today, we will see if the market is able to hold on to the critical SPY 75 level. In the early going, prices have reversed and the market feels tired. Bears will test the downside and if buyers lose faith, we could see additional selling this afternoon. Quadruple witching lies ahead and if the bulls can't recover from today's decline, it might set up a bearish bias next week. If we do recover, there is a chance for buy programs next week if the rally continues.

If I had to guess, I believe the market will test the downside throughout the day and rally into the close. We should finish above SPY 75. Optimism is starting to return to the market and there are signs of a bottom. The breath has been very positive this week and the advance/decline and up volume/down volume has been strong.

Since I don't like to guess, I will simply wait to see if SPY 75 will hold today. If it does, I will sell additional out of the money puts next week. If it does not, I will ride out current naked put positions. The recent rally has provided a great deal of cushion and my trades are out of harm’s way with one week left. Certain stocks within the retail sector are worth a look. Retail sales came in better than expected this week and consumer confidence came in above expectations. You need to be very selective and look for stocks that make money on transactions or retailers that have grown the top and bottom line. These will be my put writing candidates next week.

Daily Bulletin Continues...