Momentum and Short Covering Fueled A Breakout. Will It Hold?

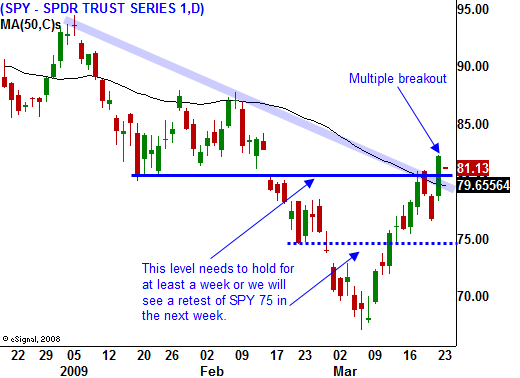

Yesterday, the market embraced the Treasury's toxic asset plan. Prices shot higher from the open and early momentum sparked short covering. By the end of the day, the market had broken out above major resistance at SPY 81. Now, it has to maintain that level for the rest of the week to prove that buyers are ready to put money to work.

Over $9 trillion sits on the sidelines anxiously waiting for signs of improvement. To date, bulls have bought on dips, but they have not chased prices higher. This week, we will see if that has changed. Money managers don't want to get caught flat-footed and they want to put money to work once support has been established. I still don't believe that any of them feel as though a runaway rally is just around the corner. Shorts will have to respect this breakout and they will be covering their positions.

In a two week period of time, the market has rallied almost 25% from its lows. The breath has been exceptional and I believe a long-term low has been established.

Tomorrow and Thursday, we will see how the market reacts to a splash of cold water. Durable goods orders have been extremely weak and a bad number is expected. Initial jobless claims and GDP will be released on Thursday. Both have continued to deteriorate faster than expected. Personal consumption accounts for 70% of our GDP and if the job situation doesn't improve, consumers won't spend money. Business investment dropped 25% in the fourth quarter and if companies aren't expanding, new jobs won’t be created. Given the recent market run-up, we could see a pullback as reality sets in.

The first signs of a bounce came when China released its third consecutive rise in PMI. Unfortunately, they can spin their numbers anyway they choose and don't trust them. They have increased their stimulus plan, but I doubt that one country can pull the entire world out of an economic disaster. Europe is in even worse shape than we are.

Commodity prices are moving higher, but production has been scaled back dramatically and even a slight increase in demand will cause prices to move higher. Furthermore, a weak dollar has accounted for part of the commodity rally.

Banks say that they are making money and that is a very positive sign. To put this into perspective, Citigroup said that they made $8.3 billion in January and February (not including write-downs). Unfortunately, they have $350 billion in toxic assets and they owe taxpayers $45 billion. It will take years for them to get back into the black.

The bailouts and the stimulus plans all sound great, but we are mortgaging our future. Bad decisions have been made and someone (shareholders, homeowners or taxpayers) will have to pay the price. There is no magic wand that will make all of this go away and printing money is certainly not the solution. Consequently, I don't believe that anything the Fed or the Treasury do will have a lasting impact on the market. They are simply postponing our pain.

Bear market rallies can last longer than anyone expects so I will respect the breakout. However, the next few days are critical. If bullish speculators start piling in, we could see a failed breakout and a nasty reversal as they are taken to the cleaners. I am not getting long today, but I will be getting short if the SPY breaks below $80.80. That would be a new intraday low. I will also sell out of the money call credit spreads on weak stocks that have bounced and are hitting resistance. I have my candidates lined up and I'm ready to fire.

On the other hand, if the market is able to weather the economic news tomorrow and Thursday, there's a chance that this rally could continue. In that event I will opt to sell out of the money put spreads on commodity stocks.

I can't determine which way the market will swing today, but I am ready with an order to short if it falls apart this afternoon.

Daily Bulletin Continues...