Market Taking A Breather – Buyers Will Step Back In Later This Week!

The table was set for a nice opening this morning. The market recovered from last Friday's dismal Unemployment Report and it finished unchanged for the day. Overseas markets where strong, particularly in Asia and the S&P Futures were unchanged a few hours before the open.

An ex-analyst from Deutsche Bank casted a dark cloud over US banks and he stated that many future problems still exist. Before the open, IBM yanked its $7 billion bid for Sun Microsystems. Both events seemed to weigh on the market.

Given the bullish momentum the last few weeks, bears did not want to go home short over the weekend. I believe the selling pressure was already in the marketplace last Friday and all it took was a couple of minor news items to push it lower this morning. After our weak open, Europe followed suit and declined as well.

As I mentioned last week, the news has not been all that positive. However, the market wants to focus on the silver lining in each story. This bear market rally needs to find its legs this week to put pressure on the shorts. If it can recover and move higher in the next few days, next week's option expiration could have a very bullish bias since the market is near its one-month high.

The earnings and economic news front will be very quiet this week and I believe that favors the bulls. The market has been able to move higher in spite of negative releases and it won't have that drag ahead of the holiday weekend. Lighter volumes will also favor the bullish short-term momentum and traders might feel they can put the squeeze on shorts.

The economic news has been horrible. Durable goods orders, GDP, housing prices, housing sales and unemployment are near their worst levels in decades. Bulls argue that these statistics are backward looking and that the actions by the Fed and Treasury are starting to take root. The market was grossly oversold and now it is reaching a short-term overbought condition.

I still feel that the bulls have more ammunition to push this market higher and that some of the $9 trillion that sits on the sidelines will be put to work ahead of earnings season.

Banks will nominate the first two weeks of earnings and I see that as a negative (after option expiration). Financial institutions have rallied on news that the first two months this year were very good. Stocks in this sector have rebounded smartly and there is a chance they will disappoint. Citigroup's profits came mainly from AIG payments that it had already written off. Most banks have also stated that March was not a good month.

I am selling front month put premium with the idea that support at SPY 75 will hold into expiration. I am mindful that this is a bear market rally and that all bullish positions need to be scaled down since we are trading against the long-term trend. Energy seems very volatile at this level and oil inventories are high. I am avoiding those stocks for now. Retail, restaurant and tech are holding up very well.

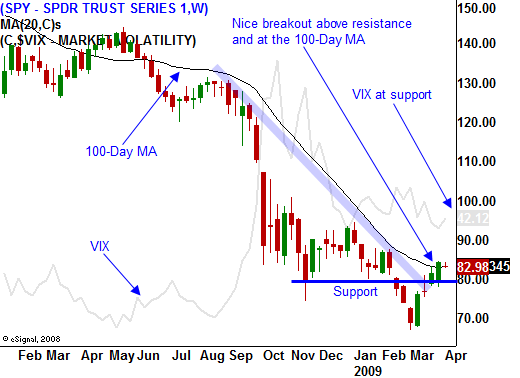

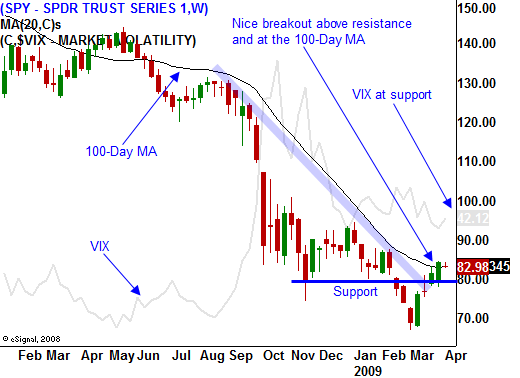

The market is back below its 100-day moving average. The decliners led advancers by a 4 to 1 margin and the momentum today favors the downside. The 20-day and 50-day moving averages are at SPY 80 and I expect that level to hold. That is also a horizontal support level. As the week progresses, I expect buyers to step back in. Today's news was not that bad and the market is simply taking a breather.

Daily Bulletin Continues...