Today’s Selling Should Continue Tomorrow!

After a very strong showing last week, the market is giving back much of the gains this morning. In one quick move, we are testing the lows from last Tuesday.

The market has staged a great six-week rally and it is tired. News from the financial sector helped to spark the move higher. Last week, we heard from Goldman Sachs, J.P. Morgan and Citigroup. Wells Fargo and Regions Financial also preannounced with better than expected results. Banks are starting to make money, but they are far from out of the woods.

This morning, Bank of America splashed cold water on investors. They handily beat estimates, but negative comments over bad loans overshadowed current earnings. The CEO did not want to provide any guidance; he simply said that loan defaults would continue to increase. Bank of America made 86% of its profits from Merrill Lynch. Many analysts believe that they could need another $36 billion to beef up their balance sheet. In a few weeks, the government will start releasing the results from its "stress test" and Bank of America is not likely to pass.

Over the weekend, White House Chief of Staff, Rahm Emanuel, said that there is a strategy that the government could use to shore up 19 banks without lending them more money. The plan is to convert government loans into common shares. While it would strengthen balance sheets, it would increase the risk to taxpayers. They would be reduced to common shareholders. Existing shareholders are not overjoyed either since this would be dilutive. Banks are not happy with that solution since many of them want to repay the TARP loans that were forced upon them. The market doesn't like the idea of nationalizing our banks and in many instances; our government would become the largest shareholder.

These developments are not really new, they've been looming for some time. Perhaps the biggest issue is uncertainty. The government keeps vacillating back and forth and traders don't know what to expect week to week.

This morning, Oracle made a cash offer for Sun Microsystems. That shows that there are values in this market and companies are willing to put cash to work.

This will be a very busy week for earnings releases. After the close, we will hear from IBM, Texas Instruments and Zion's Bank. I expect those results to be good. Before the open we will hear from the following financials; BK, NTRS, STT and USB. These companies are solid and I'm expecting good results. We'll also hear from AKS, CAT, KO, DD, JCI, LMT, MAN, AMTD and TRA. For the most part these earnings are likely to be weak. This group includes cyclical stocks and I don't expect them to show signs of an economic recovery. Consequently, today's decline could continue tomorrow.

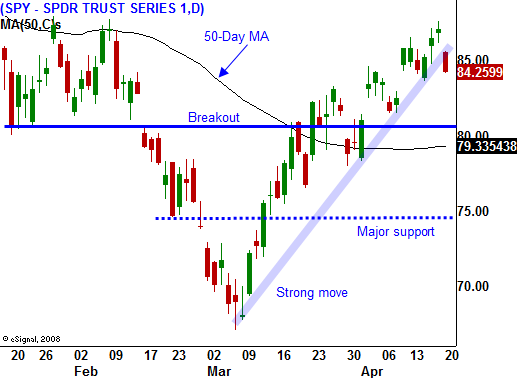

The market has been very resilient and I believe it will find support at SPY 80. That level represents horizontal support and is just above the 50-day moving average. The worst case scenario would be a decline to SPY 75. That is a six-year support level.

Asset Managers have been waiting for a pullback to buy stocks. They don't want to chase prices and after last week's rally, they will patiently wait for a better opportunity. In the last few weeks, the market declines have been very brief and prices have snapped right back. That tells me that buyers are anxious to put money to work.

Last week, we saw Goldman Sachs and First Niagara raise private equity. Dry Ships (a debt-laden dry bulk carrier) was also able to raise capital. Money is gradually finding its way back into stocks.

When the market does find support, it will establish a higher low and that is bullish. Last week, I had considered selling out of the money call spreads on stocks that have rallied. Today's pullback has me feeling like I missed that opportunity. At this juncture I would rather wait for signs of support and I will sell out of the money put credit spreads when we stabilize.

Decliners are outpacing advancers by 10 to 1 and we are likely to see selling into the close. I am keeping my powder dry today and I want to see how far this market can drop before buyers start to show interest.

Daily Bulletin Continues...